You can barely pick up your virtual paper these days without being assailed by the angst over government deficits. Higher bond yields – driven, we are told, at least in part by surging deficits1 – are widely regarded as the harbinger of “the end of the new normal”.2 With inflation at least temporarily in abeyance, persistent fiscal deficits and scope for ongoing fiscal irresponsibility are increasingly cited as the #1 reason investors should stay short bonds – or at a minimum are now cited as being even more important than the Fed as drivers not only of bond yields, but even of markets in general.3

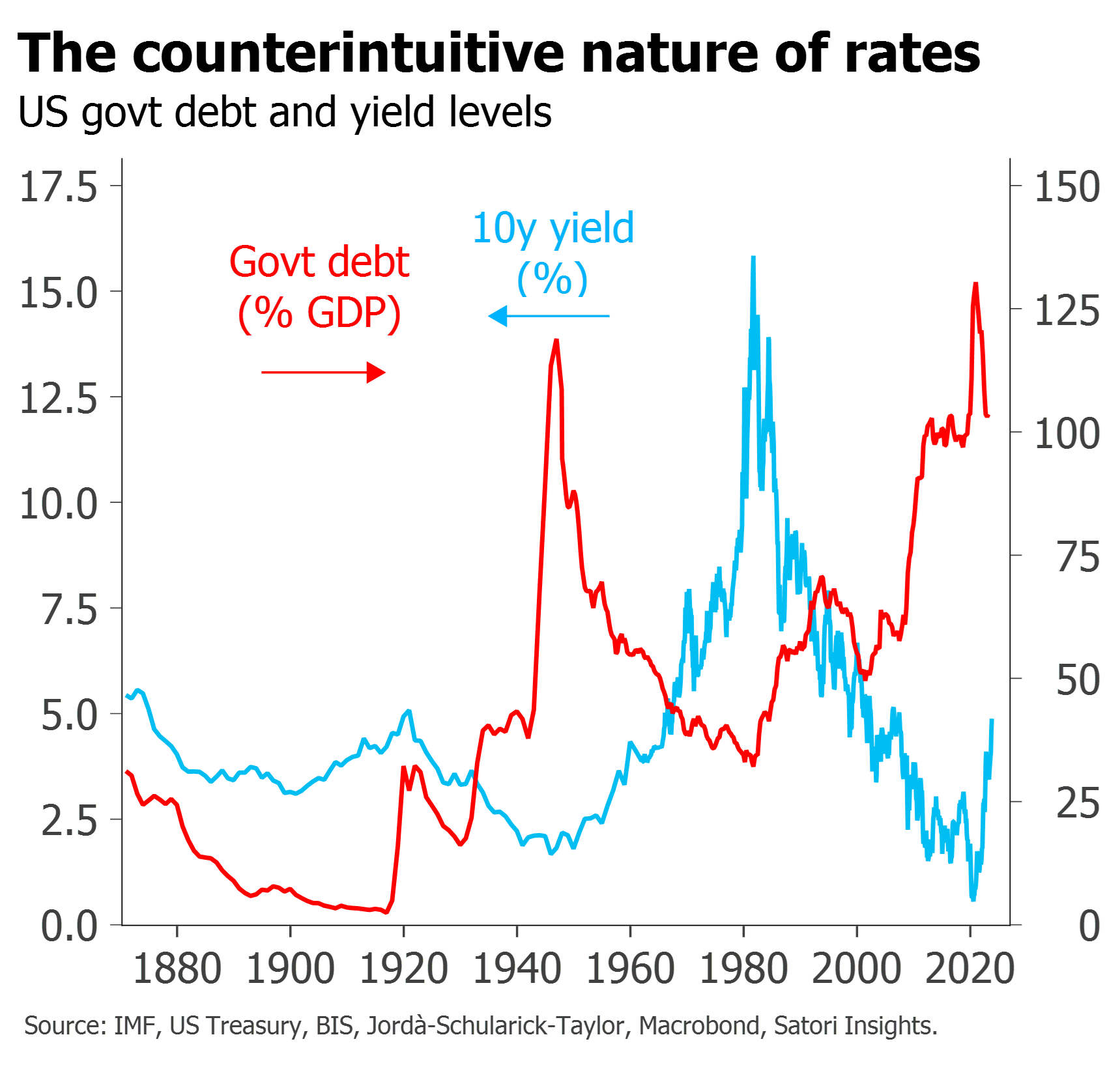

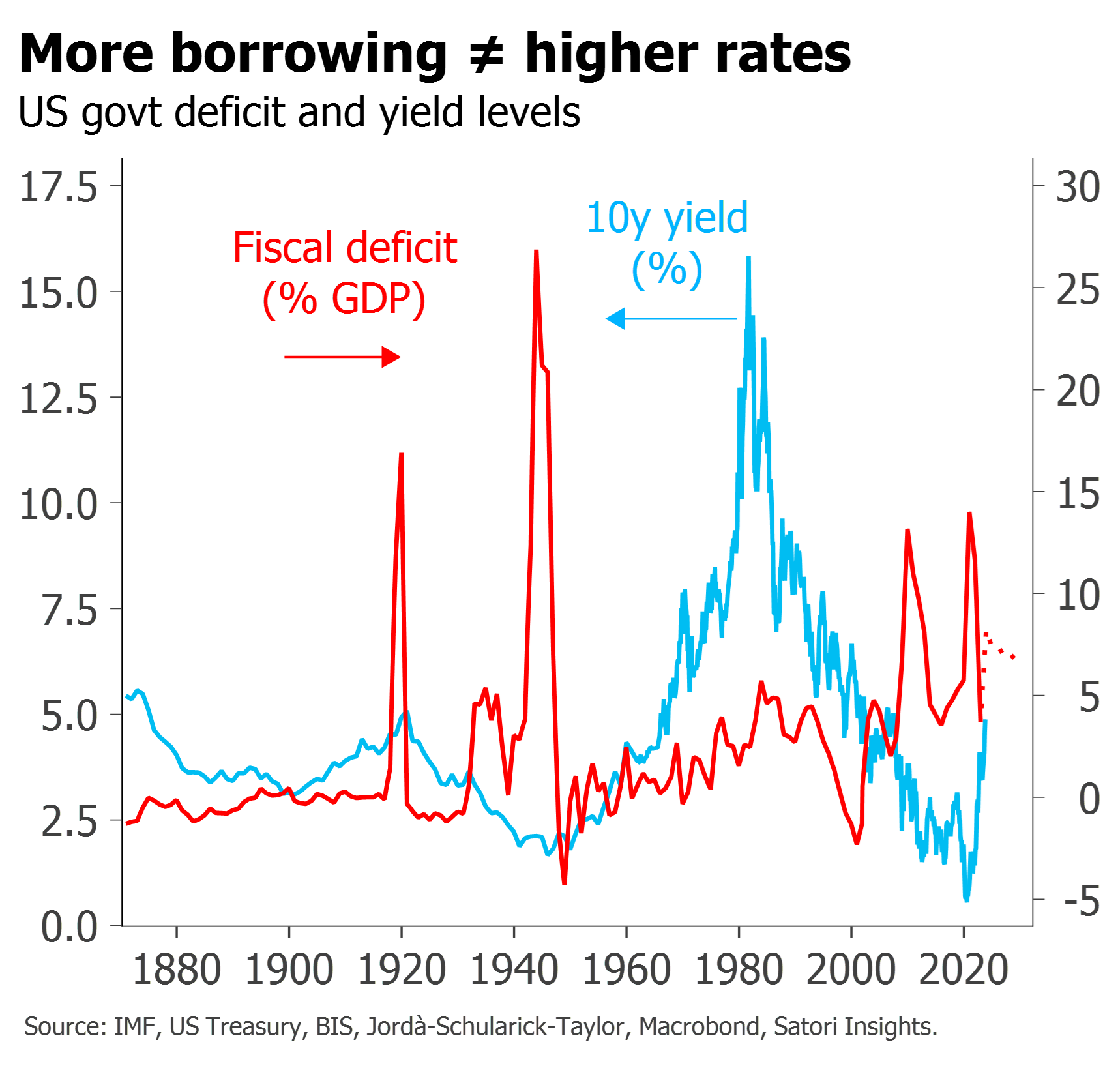

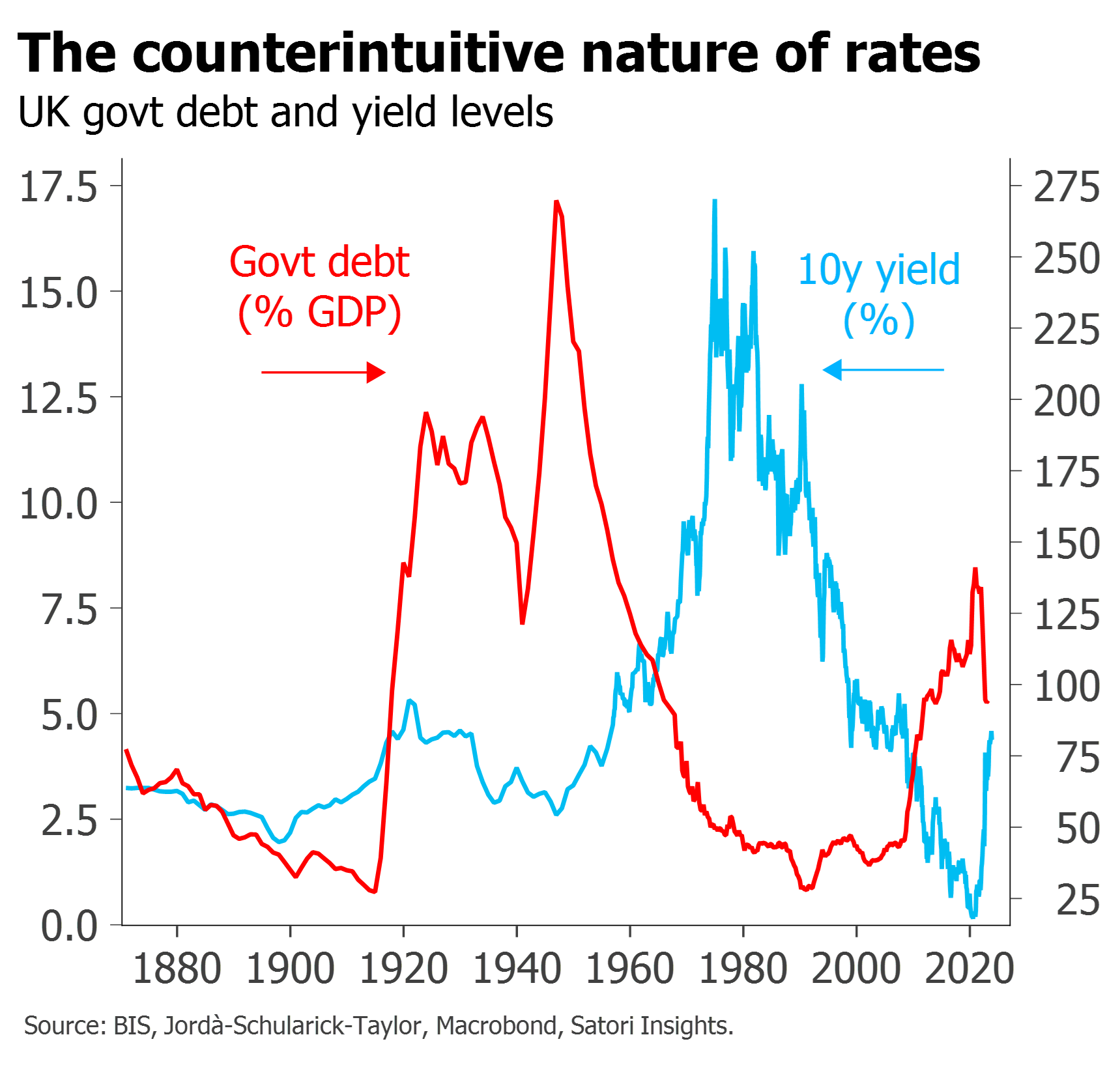

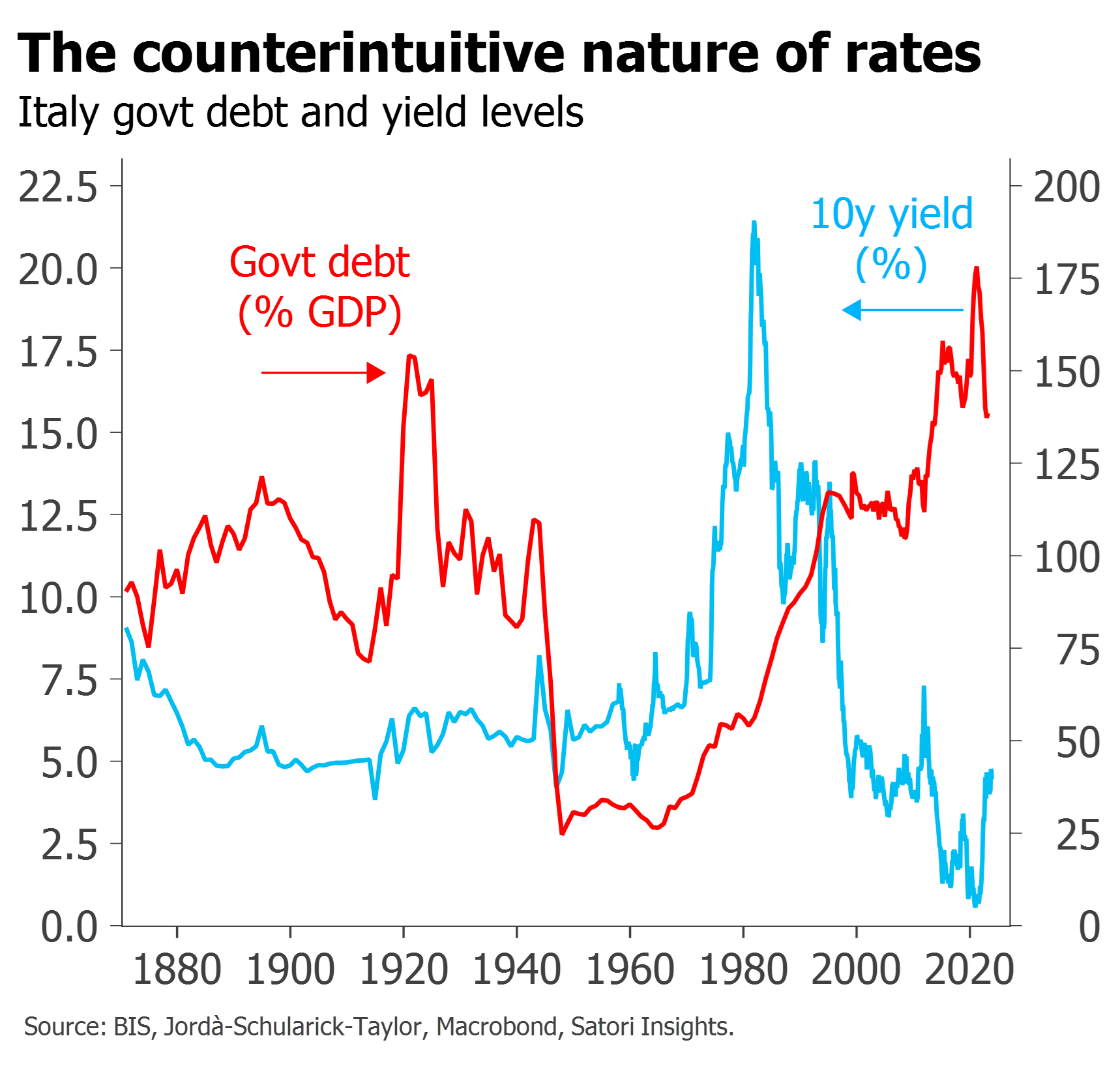

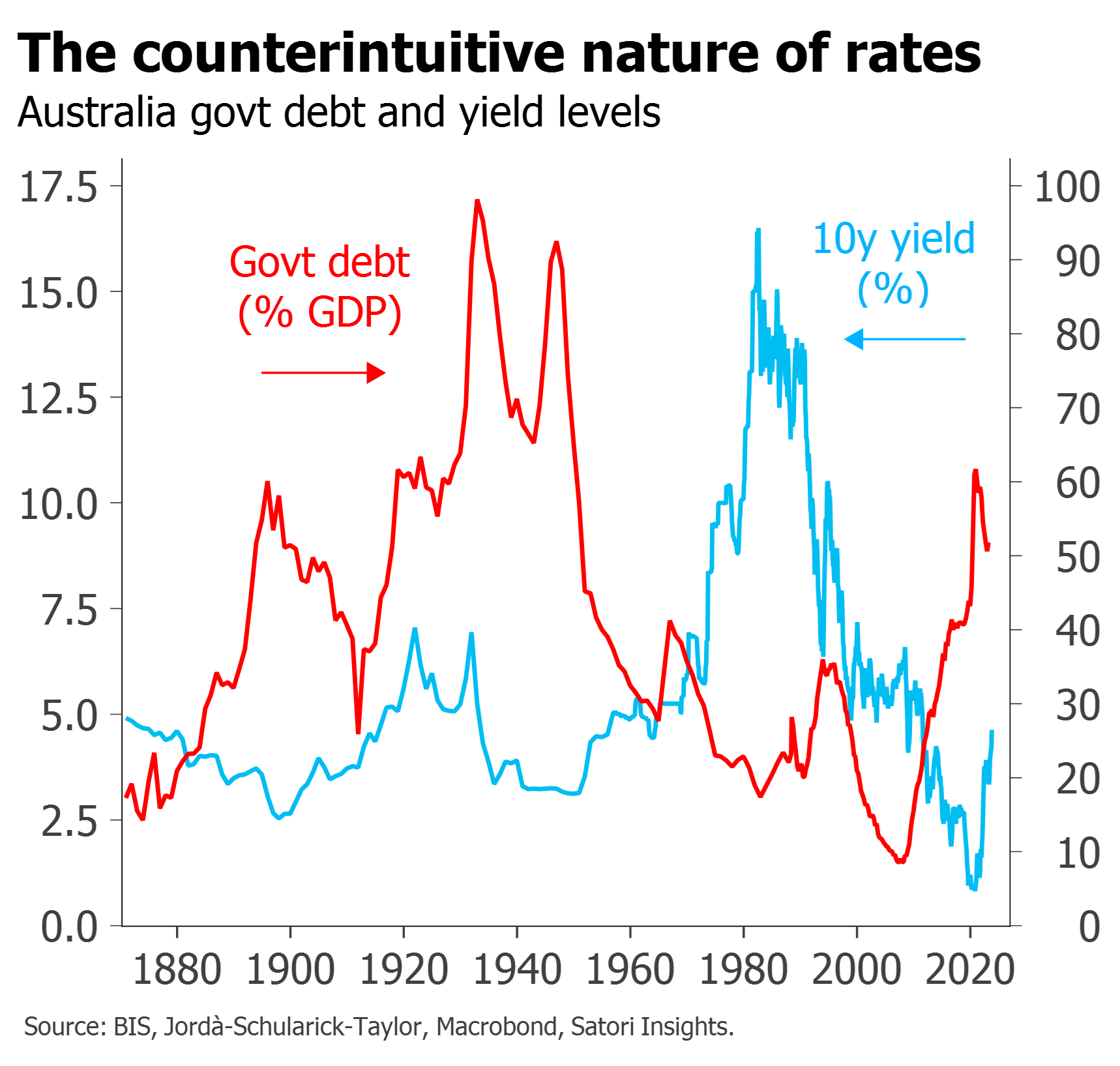

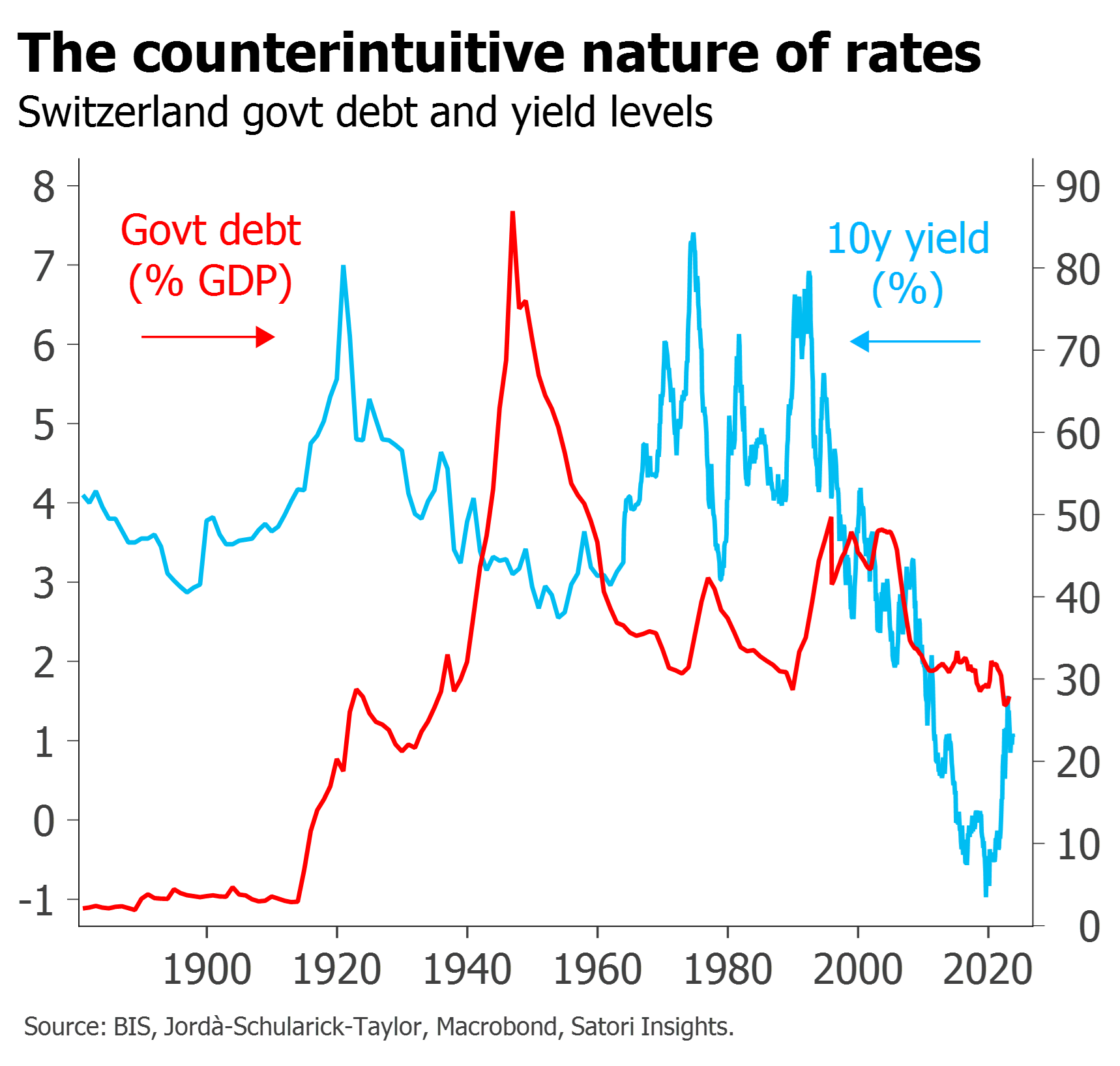

But as is often the case in finance, and especially fixed income, what seem at first sight like perfectly reasonable, economically grounded, assertions turn out not to bear closer scrutiny. The historical record is quite clear: higher government debt levels have been associated with lower bond yields, not higher. Even when we look at fiscal deficits and yield changes the picture remains counterintuitive.

This piece examines the data and explains what lies behind it. We show not only that new bond buyers are already emerging – just as they have done historically during eras of high deficits – but argue that under most circumstances this is an intrinsic feature of the process of fiscal financing. This is not to condone persistent deficits, nor to argue that they do not matter at all: there is always a danger of becoming the next Liz Truss. But to go from worrying about deficits to wanting to be short bonds not only overlooks the evidence that most of the time there are other, bigger drivers of bond yields, and fails to attribute sufficient importance to credibility; it fails to understand the very nature of the credit creation process itself.

The Carville conundrum

Every bond buyer worth their principal sooner or later comes across James Carville’s famous quip about wanting to be reincarnated as the bond market.4 A few of us may even have dreamt of it. But until very recently, the paradox was that for the past two decades the bond market has looked more like a giant pussycat than something to be scared of. And this had been happening even as deficits skyrocketed first with the GFC and then with Covid, and as government debt spiked to levels not previously seen outside wartime.

Now, of course, Carville’s tiger is back – and indeed market discussion this year has consisted of little else.

Latin lessons

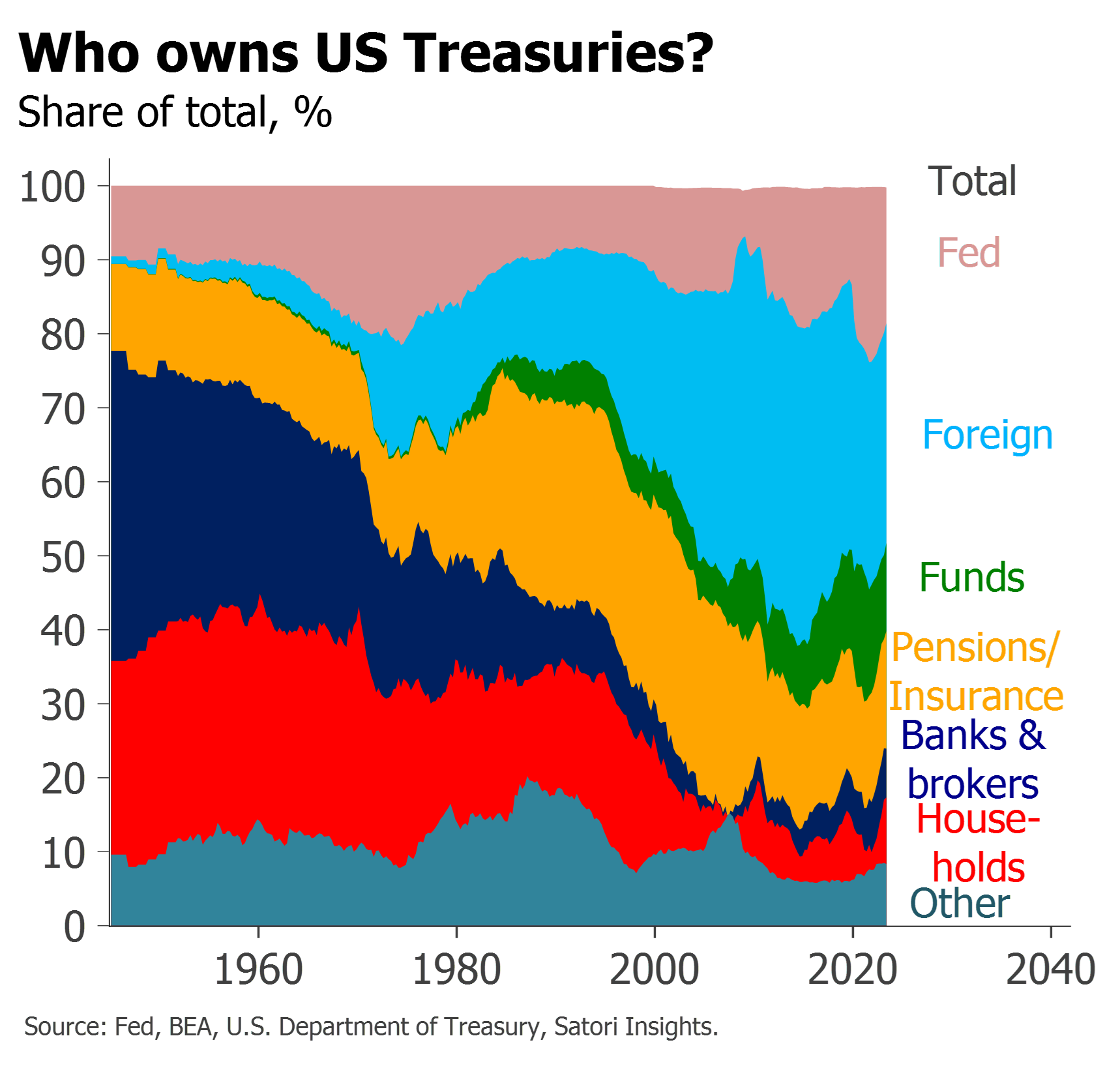

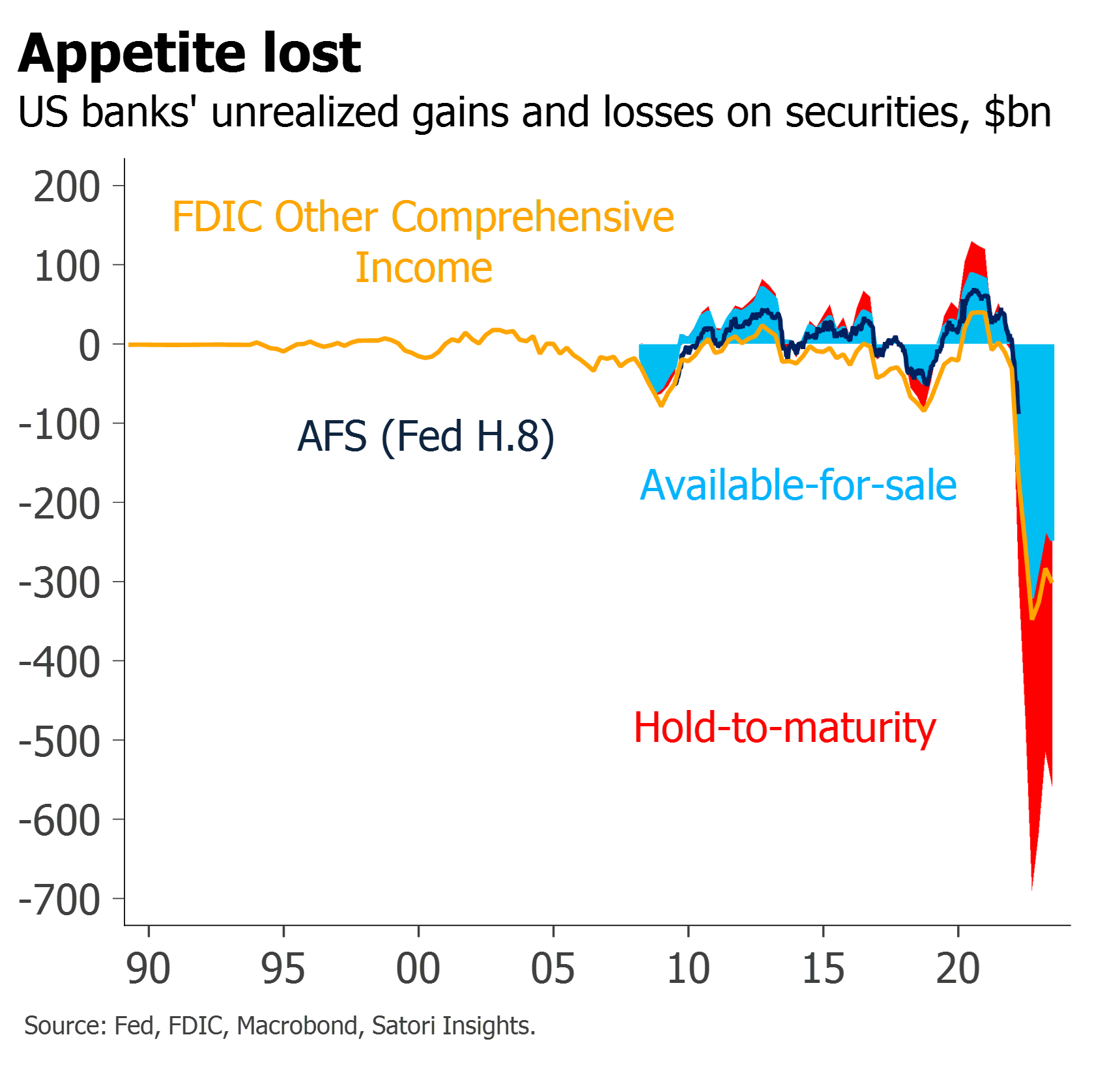

At first sight, there is plenty to be scared of. Bond strategy reports are full of worrisome statistics about trillions of supply – $1tn in US Treasuries this quarter alone – with large question marks as to who will buy them.5 Bond auctions have been tailing, or auction sizes being reduced.6 Except for the BoJ, the central banks are now net sellers. Foreigners have often been sidelined by inverted yield curves destroying the FX-hedged yields.7 And as SVB aptly demonstrated, banks are nursing such large losses on their existing holdings that they seem unlikely to want to add to them any time soon.

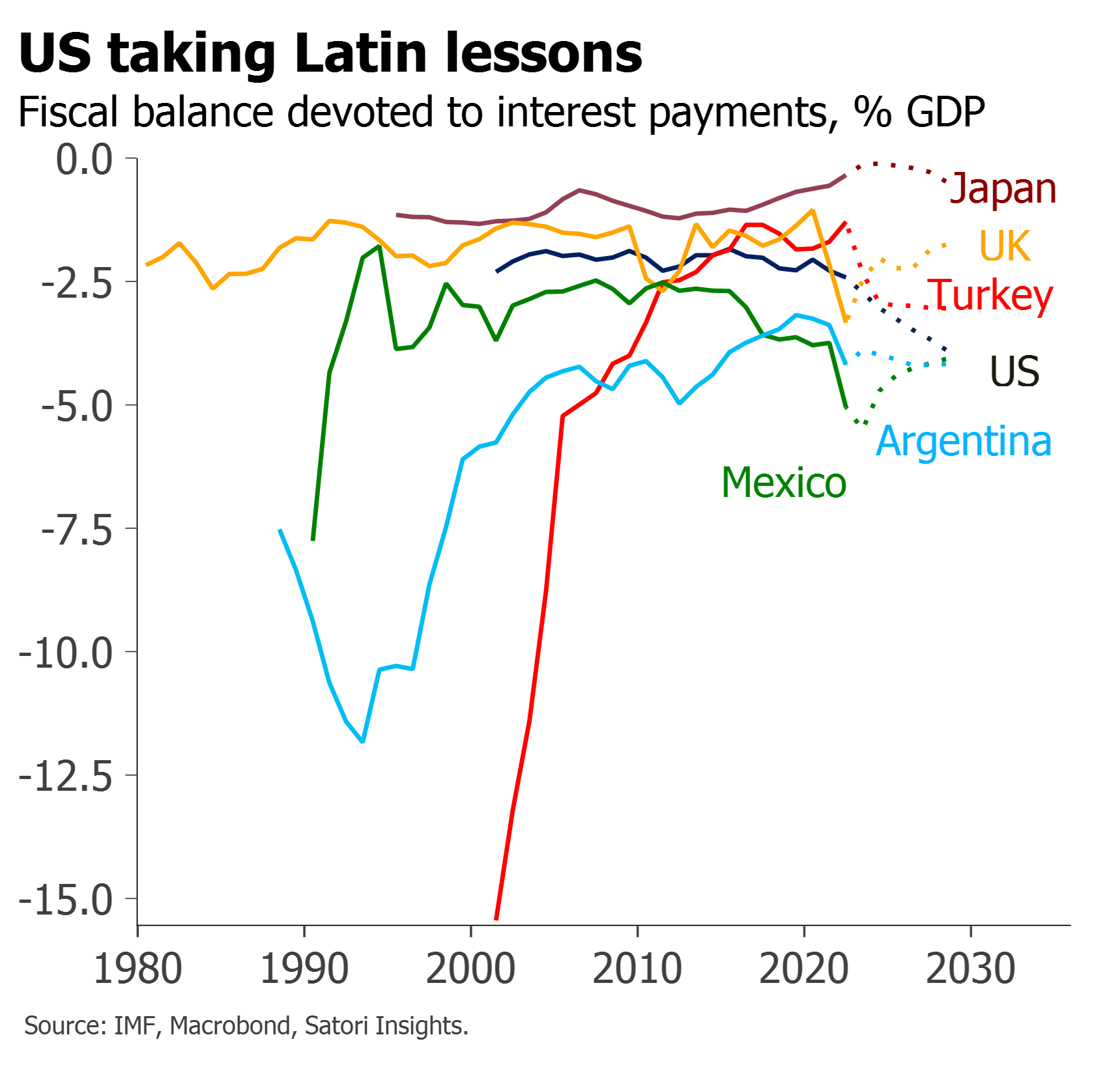

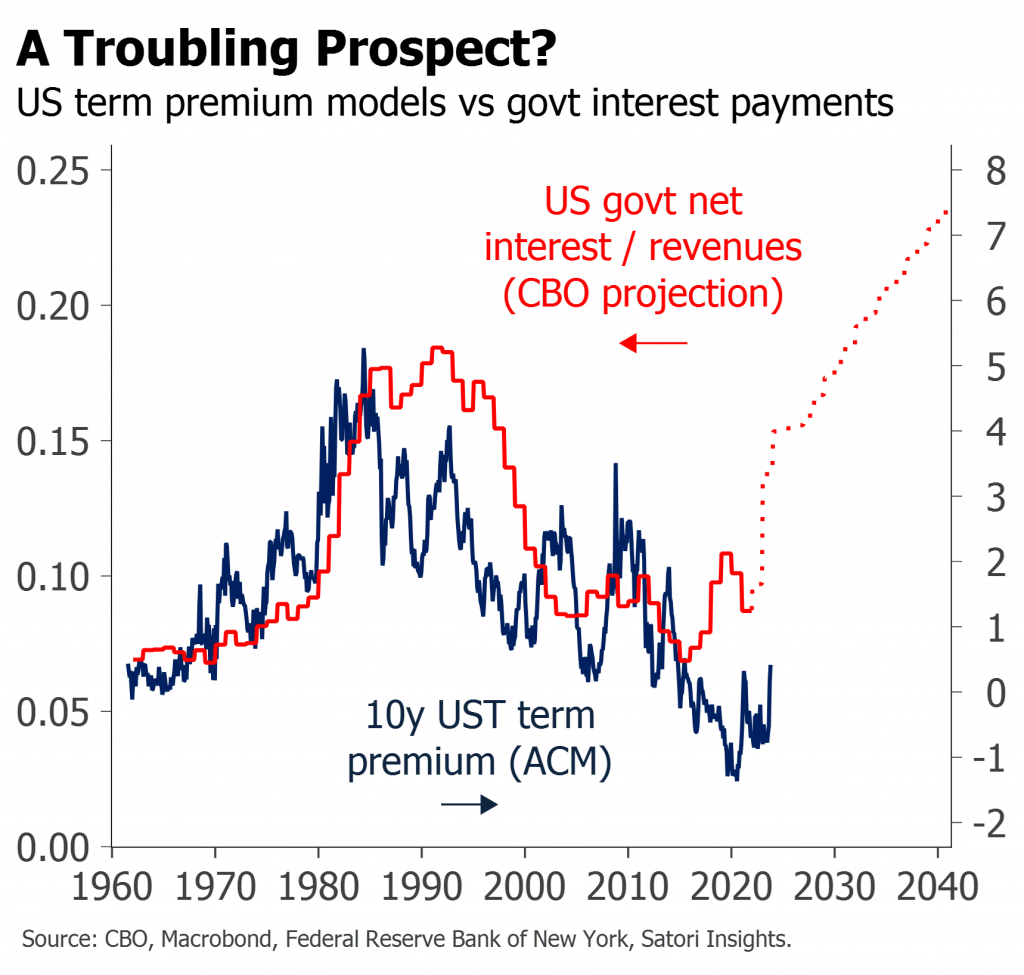

Estimates of future borrowing needs and the apparent inevitability of bond maths have compounded8 these concerns. Interest payments in the US are already some 2.5% of GDP or 16% of government revenues.9 By 2030 they will not only have passed their early 1990s peak; the IMF estimates they will be at roughly the same level as those of Argentina and Mexico. If historical correlations with term premia were to hold, this could lead to risk premia alone on 10-year Treasuries surpassing 4%, even before real rate and inflation expectations are factored in – threatening a potentially self-reinforcing loop.

In praise of Mom’n’Pop

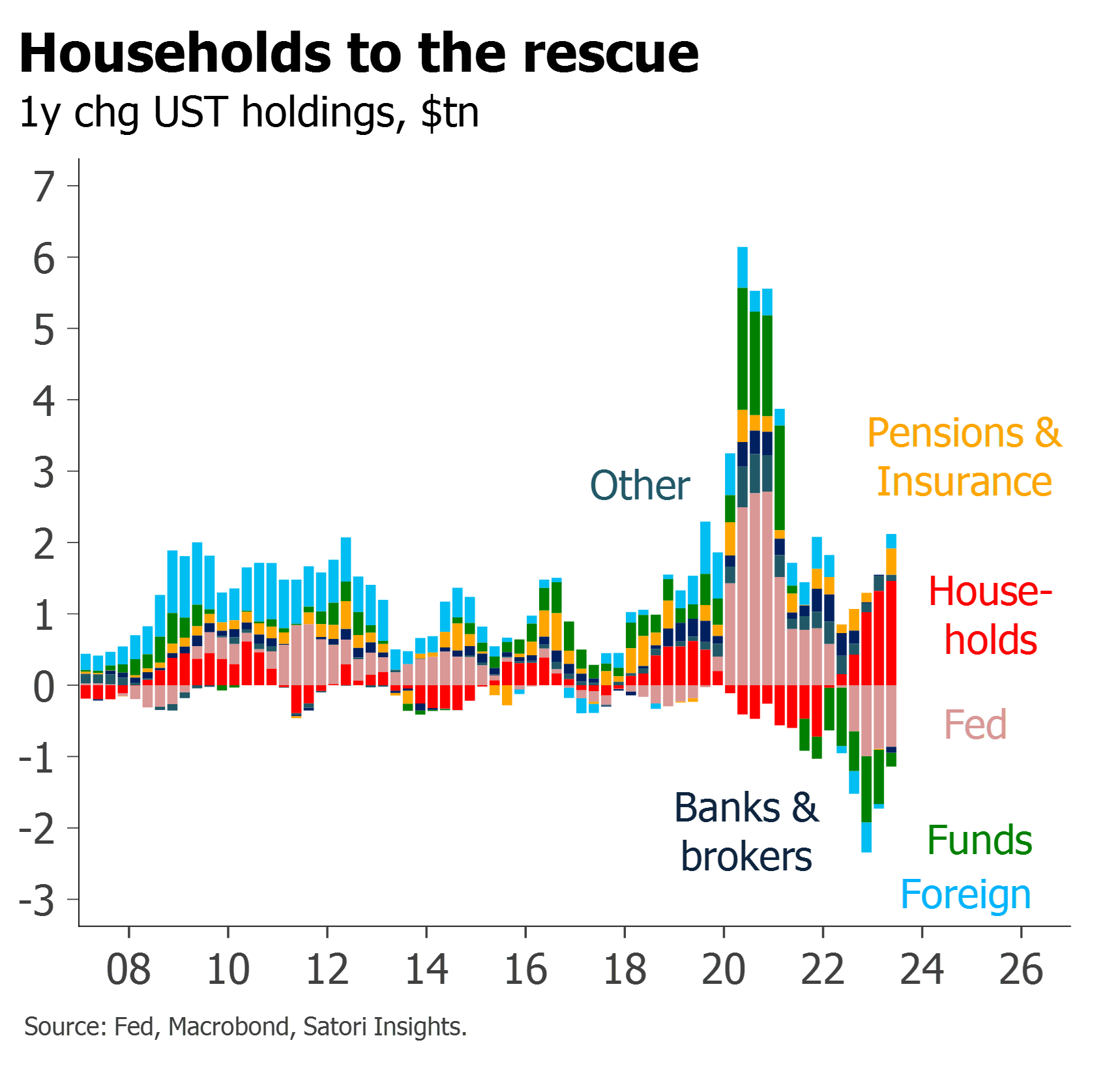

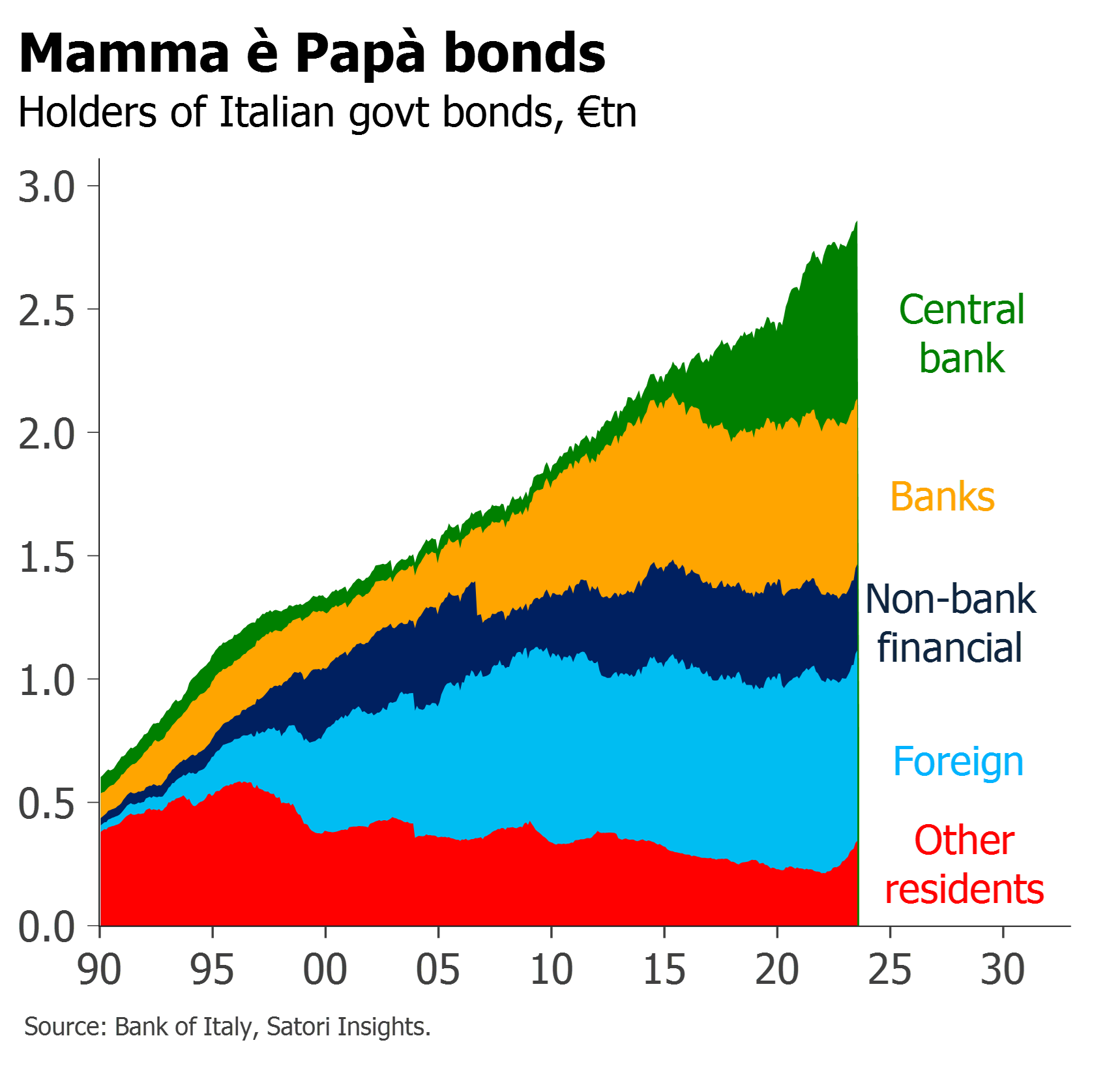

Look a little closer, though, and new buyers have been stepping up. In the US, purchases from ‘households’ and pension and insurance money have stepped in to the void left by the Fed, foreigners and banks. This may not have been enough to prevent yields from rising, but that was also in an environment where mutual funds and ETFs were net sellers. Even in potentially more problematic cases like Italy – where the central bank had absorbed basically all of the net supply since 2015 – households have shown strong demand.10 European governments have sold well over €60bn to households this year – in many cases multiples of what they had originally planned.11

Might households and pension money be capable of arresting the “greatest bond bear market of all time”,12 or will ongoing deficits and rising risk premia condemn them to even greater losses amid a general stampede for the exits? Let us turn to the lessons from history and from the credit creation process.

Neither bunk, nor junk

Fortunately for angst-ridden bond buyers and antagonized Treasury Secretaries alike, history has quite a lot to say on this matter – and it’s as surprising as it is encouraging. Higher government debt levels have in the past been associated with lower yields, not higher ones. The finding is not confined to the US: it holds in Germany and Italy, Japan and the UK, Switzerland and Australia – and all the way back to the 1880s. It might be too much to call it a correlation, but it’s definitely closer to being an inverse relationship than a positively correlated one. We think this is so striking it bears repeating.

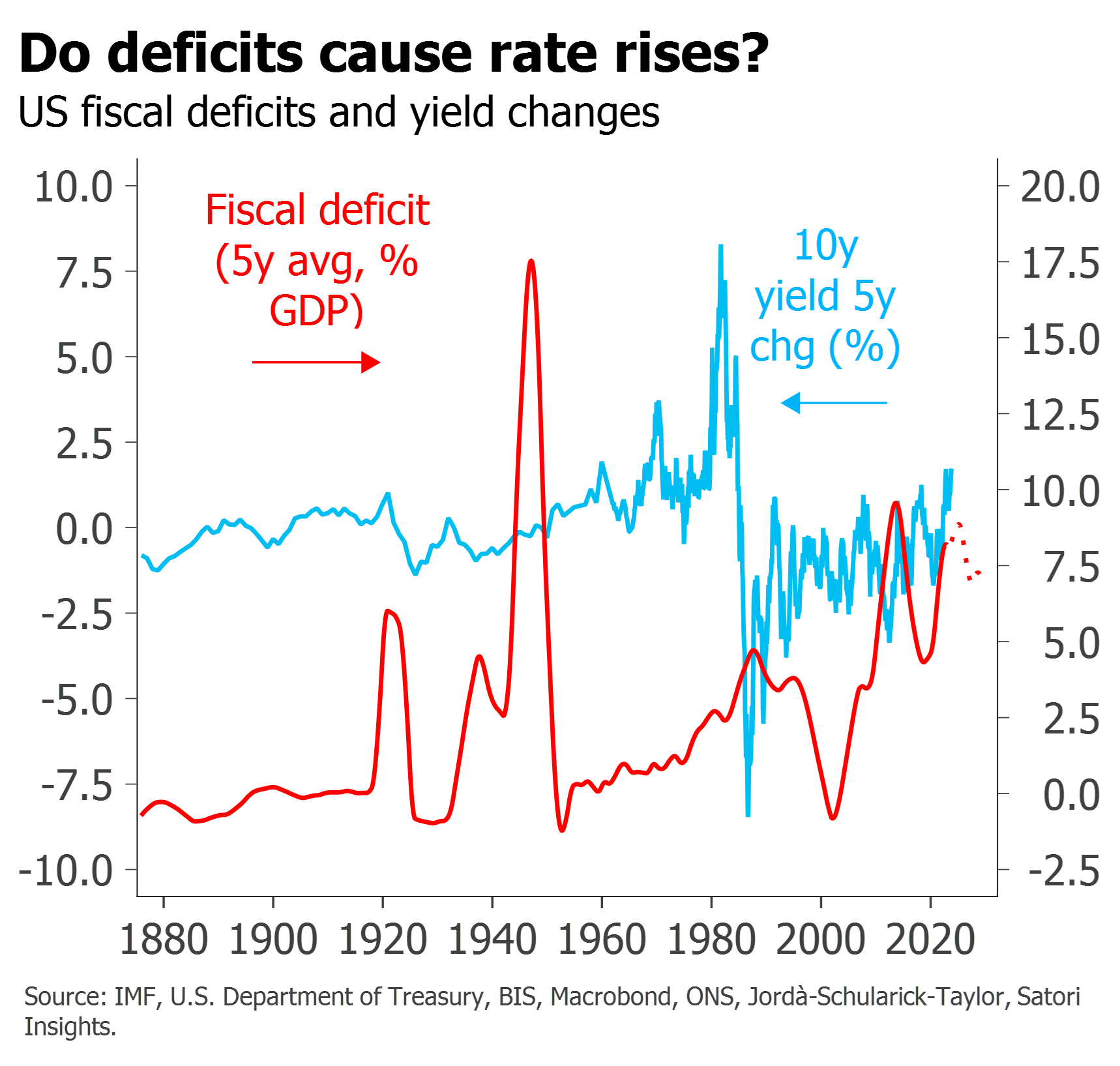

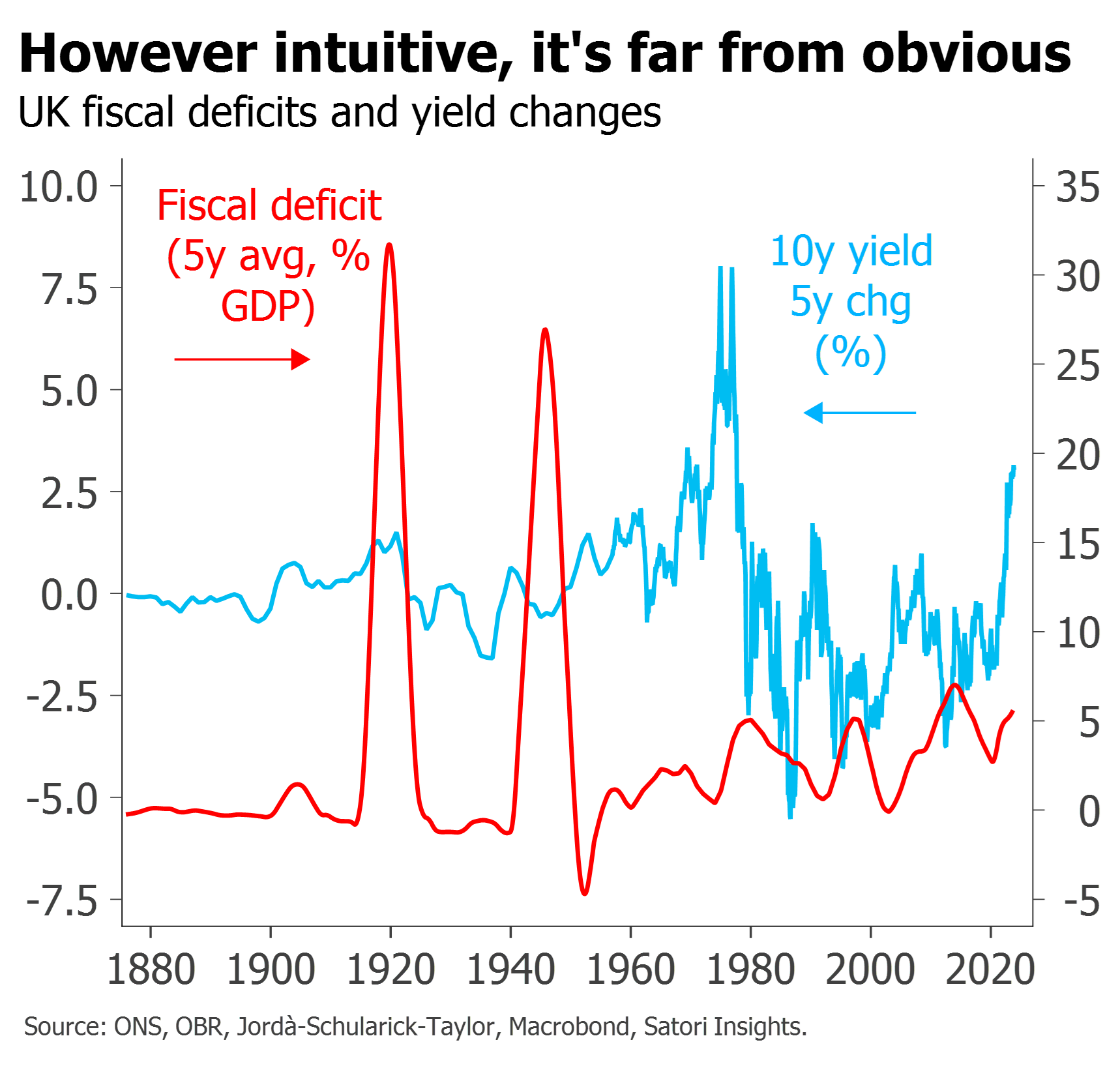

Nor is this just some freak feature relating to yield and debt levels, as opposed to changes. Play around with yield and debt changes and you find the same thing. Even if we use fiscal deficits – arguably a fairer test of the impact of the actual process of borrowing – and plot them against yield changes, it is still far from obvious that increases in borrowing drive yields higher. On either annual or longer-term changes, for every occasion where it looks like that’s the case, remarkably, we can find at least one where it looks more like the opposite.

In defence of Ms Yellen

How can this be? Surely this finding defies the basic laws of economics? All other things being equal, more supply ought to drive prices downwards and yields higher, and vice versa.

The answer, of course, is that in economics all other things are never equal – at least once one escapes the rarefied atmosphere of undergraduate lecture halls. This is one reason we invariably prefer to look at what the data shows first, and then wonder what theory might explain it only later. We are consistently amazed how few market participants do the same thing, often instead citing theory with scant regard for the data. This applies particularly to the impact QE has had on both bond yields and markets.13

On this occasion we can think of at least three reasons why yields may actually move lower during periods of high borrowing: two empirical, one theoretical.

The first is financial repression. During eras of particularly high debt, governments famously make use of every tool at their disposal to hold down [real] yields. This need not be confined to QE and need not be explicitly orchestrated by a single central authority; it can also include everything from leaning on banks to buy more government bonds – either by moral suasion, through specific facilities like the ECB LTRO, or through new regulations like Liquidity Coverage Ratios – to capital controls and the outlawing the private holding of gold in the 1930s.14 But it seems unlikely this has been the dominant driver of the relationships shown above: financial repression is traditionally applied only when debt levels are very high, and the relationship seems to hold even at lower debt levels.

A better explanation, in our opinion, is that invoked by Ms Yellen. Current hysteria aside and pace Powell’s comments in recent speeches, the general lesson from history and certainly the obvious driver throughout most of our career is that economic strength and future rate expectations, not deficits, are the primary driver of bond yields.15 We might quibble as to whether the driver on this occasion was really “natural” economic strength – the main theme of our recent webinar was the way in which both markets and the economy this year have been propped up artificially by $800bn of what amounts to de facto QE, now receding – but the principle remains the same. Rate expectations and the cycle are more often than not the primary drivers of bond yields, with deficits playing a secondary role.

Perhaps the easiest way to show this is to look at what debt and deficits do correlate with. This is not yield levels per se, but the yield on government bonds relative to a more supply-agnostic metric, swap rates.

Higher debt is associated with govies trading cheaper relative to swaps, i.e. less negative or more positive asset swap spreads.16 Higher deficits are associated with govies needing to cheapen relative to swaps. These relationships may have weakened during the QE era, but to us they fit with both theory and the data far better. They hold both through time and across markets.

These two factors together help explain why the correlations we started with are closer to being negative than positive, i.e. why higher debt and deficits are more often associated with low yield levels than high ones. They may cause govies to cheapen up relative to swaps, but they are more likely to occur during periods when the economy, inflation and hence rates are low rather than high.

This is not to say that deficits never matter for bond yields at all – Druckenmiller does have a point too in alleging that the US might have done more to term out its debt17 – but before we consider those circumstances we need to consider the third reason why under most circumstances government deficits fail to be associated with higher bond yields. The remarkable truth is that most of the time deficits are close to being self-funding.

Credit ex nihilo

You don’t need to work in a syndicate department to see the inherent logic in the statement that “someone needs to buy” each bond issue. The more you want to issue, the more buyers need to be found. But the mind-bending truth is that most issuance is much closer to being self-funding than is widely recognized – especially in the case of governments, but even in the case of corporates.

To see this, we need to consider how the leveraging process works – not only for the borrower and the buyer of the bonds, but at a system level.

When a bond is issued, yes, clearly, someone somewhere – usually a private investor – needs to buy it. Typically they will do so by taking deposits from their bank account. But take a moment to consider the process as a whole.

What happens to the proceeds from the bond sale? Provided that they are not simply squirrelled away at the central bank, provided that at some point they are spent in the real economy – paying a government employee, building a piece of infrastructure, even helping to reduce someone’s tax bill through tax cuts – they produce an increase in bank deposits which exactly offsets the amount the private investor drew down for the purchase. Total bank deposits – or narrow money – are left unchanged.

But where it gets weirder still is when we consider what happens to assets and liabilities in the system as a whole, i.e. [very] broad money or credit. While narrow money remains unchanged, the system as a whole gains assets as well as liabilities. The process of borrowing, or leveraging, itself creates ‘money’ – at least in the broad sense of total credit – from nothing.

In the stronger form in which it applies to bank lending, this process is now relatively widely accepted, in large part thanks to a paper and video from the Bank of England.18 But the breadth of its implications – in particular for the ability of borrowers to fund themselves in bond markets – has yet to be fully acknowledged.19

Provided there is sufficient risk appetite for the money to “trickle round” the system, this means the borrowing is close to being self-funding. The process of borrowing in itself creates the very money which funds it. This applies as much to a corporate, or even to an individual borrowing on a credit card, as to a government.

The only question is the price, or yield, which is required to generate sufficient risk appetite for the money to “trickle round”. And here, in our experience the system is remarkably self-regulating. An individual corporate issuer with a particular need to borrow or a desperate desire to issue a particularly risky instrument may on occasion reprice the market. But despite all the talk of “refinancing walls”, most of the time all it takes is a few bp of concession; on the occasions where appetite is genuinely lacking, the supply never comes in the first place.

Relative to corporates, governments are much more likely to operate with a fixed issuance programme- – hence Yellen’s reference to being “regular and predictable”.20 But relative to corporates, it is also much more likely that there will be sufficient risk appetite to fund them. Indeed, changes in that risk appetite – for example, whether or not the stock market is bounding higher on expectations of a stronger economy or plummeting lower given recession fears – turn out to be a much more important driver of yield levels than supply volumes. And this applies not only because those demand shifts make a rotation back into bonds less or more likely, but also because the process of bond issuance is intrinsically much closer to being self-funding than is often thought.

Trust, not Trussed

There is one final point to be made, lest all this be taken as advocacy of unlimited deficit spending and MMT. There is a point where rampant deficits come to matter for bond yields, and do have the intuitive effect of sending yields spiking higher. But – like all the most important relationships in finance – it is a deeply nonlinear one.21

Even if governments have a disproportionate advantage when it comes to generating sufficient risk appetite to fund their deficits, there is still a point where investors may balk, where inflation results, and where Carville gains his revenge.

As Japan has helped demonstrate, this is less likely to result from years and years of persistent deficits – whether or not one’s central bank has been assisting in funding them – than from the presence or absence of credibility. Credibility is a commodity, as every bank CEO knows, gained over decades and forfeited in moments, analyzable more in terms of the whims of social interaction than computable in a spreadsheet. And that applies just as much to governments as it does to banks and corporates.

Just as rises in corporate defaults tend to be sparked less by looming maturity walls and more by collapses in corporate earnings, so fiscally-inspired collapses in government bonds tend to be driven less by the inevitability of compounding interest payments and more by sudden runs on currencies leading to rises in imported inflation.

As such, we think the lesson here is not to condone fiscal irresponsibility: that would be kwasi-certain to lead to disaster. And we would completely agree about the scale of the fiscal challenges facing governments ahead: more than anything, we worry about their potential to feed into more populist politics. But while fiscal worries may already be a reason to consider adding to holdings of gold, we are not nearly so sure they are a good reason to join the $600bn of shorts in Treasuries, whether as part of a basis trade or otherwise.

- “Governments brace for fiscal reckoning from bond markets“, FT, 4 Nov. ↩︎

- “Bond yields signal the end of the new normal“, J. Cummins, FT, 3 Nov. ↩︎

- “The Big Bond Market Event Wednesday Is at Treasury, Not the Fed“, Bloomberg, 29 Oct. ↩︎

- “[That way] you can intimidate everybody.” The Philadelphia Inquirer, 21 March 1993. ↩︎

- “Oversupply of US debt leaves few takers for Treasuries“, FT, 6 Nov. ↩︎

- “Treasury bond auction runs into weak demand amid fears that soaring US debt will overwhelm Wall Street“, Markets Insider, 12 Oct. “30-Year Treasuries Had an Ugly Auction. What’s Behind the Weak Demand.” Barron’s, 12 Oct. ↩︎

- Note that this applies to fixed-rate buyers, like life insurers, only. Japanese floating-rate buyers of debt, like banks, have bought around $20bn in US bonds over the past 3m. ↩︎

- Pun intended. ↩︎

- There are lots of ways of cutting these numbers. 16% is a gross interest figure based on the BEA GDP tables. Net interest, used by the CBO and shown in the chart, is currently around half this but set to spike higher. ↩︎

- “Demand for Italy’s new BTP Valore bond at 10 bln euros on third day“, Reuters, 4 Oct. ↩︎

- “European governments go direct to citizens to fund borrowing“, FT, 13 Sep. ↩︎

- “Bonds ‘in greatest bear market of all time‘, Bank of America says, Reuters, 6 Oct. ↩︎

- “Don’t blame QT for the bond backup“, M. King, 17 Oct. ↩︎

- The Richmond Fed has a convenient summary. ↩︎

- “Yellen Says Yield Surge Is Due to Strong Economy, Not Deficits“, Bloomberg, 26 Oct. ↩︎

- Two decades inhabiting the world of credit have convinced us of the wisdom of looking at asset swap spreads – i.e. govt yield minus swap rate – in preference to the rates-world tendency to define a swap spread as swap rate minus govt yield. Analysis of surge pricing during periods of stress demonstrates clearly that swaps and OIS are much purer measures of risk-free rates than bill or bond yields, that govies should be thought of as trading at a premium or discount to them, and that the idea of swap spreads corresponding to bank credit risk was always misleading. ↩︎

- Like most Twitter-spats, we prefer to see the kernel of truth on both sides than to take sides. There are now too many back-and-forths to mention. See “Yellen Defends US Debt Policy After Druckenmiller Rebuke“, Bloomberg, 3 Nov. ↩︎

- “Money creation in the modern economy“, Bank of England Quarterly Bulletin 2014 Q1, Mar14. ↩︎

- When borrowing is funded through bank loans rather than bonds – and when a bank is therefore also leveraging its balance sheet as part of the transaction – the process is slightly different. In this case there is a rise not only in total assets and liabilities, i.e. broad money, or credit, but also in narrow money, or deposits. Leveraging through bond borrowing potentially has a slightly weaker effect: arithmetically, insofar as the increase in total assets and liabilities is smaller than if a bank also levers up, and in terms of potency, insofar as broad credit is traditionally thought to circulate through the economy less than narrow money. But in general we think this distinction is overplayed, and that broad credit deserves more attention relative to bank lending. ↩︎

- “Druckenmiller Digs In on Criticism of Yellen, Disputes Her Math“, Bloomberg, 3 Nov. ↩︎

- Put more memorably by Rudi Dornbusch: “In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.” ↩︎