Satori Insights is a financial market research and consultancy firm founded by Matt King in 2023.

‘Satori’ means ‘understanding’: in particular the sudden flash of enlightenment that comes with intuition rather than rote learning.

Satori Insights aims to convey that same experience to participants in financial markets. We do so by a relentless focus on what’s really driving market prices, and then imparting this in the most concise way possible.

Rather than starting from economic views and then being surprised when market moves don’t correspond to them, at Satori Insights we start by trying to understand financial markets and then back out the implications both for future market moves and for the economy.

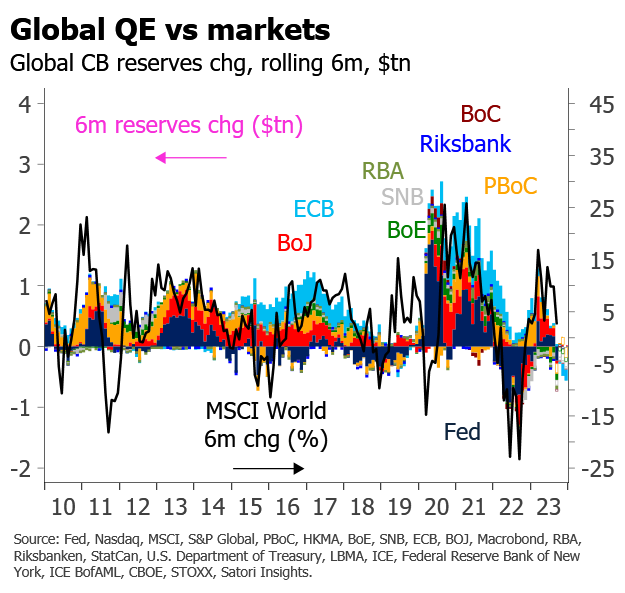

We find a significant breakpoint in many financial markets round about 2012. Before then, asset pricing could be argued to be broadly consistent with economic fundamentals. Since 2012, other factors have tended to dominate – central bank liquidity in particular. This has not only caused investors with more traditional frameworks to underperform; it has had dramatic implications for the entire markets ecosystem: from fund flows, to default rates, to secondary market liquidity and market microstructure.

While many market participants pay lip service to the impact of QE and QT, at Satori Insights we demonstrate its direct impact on market prices, stripping out currency effects and incorporating it within a broader framework of private sector credit creation.

The result is a radically different way of thinking about the interaction between interest rates, inflation and asset prices – one at odds with most economists’ and central banks’ conceptions of how markets are “supposed” to operate, but with its roots in traditional monetary theory and which many professional market participants find more intuitive.

Pricing is per institution, and determined by subscriber numbers and level of intensity.

Matt King is founder of Satori Insights, a macro and credit strategist, and one of the most widely followed commentators on financial markets. In 2000, he coined the credit-equity “clock” – still a cornerstone of many investors’ asset allocation processes. In 2007, he foresaw the underperformance of super-senior CDOs of ABS relative to more junior tranches. In 2008, his piece Are the brokers broken? predicted the fall of Lehman and showed explicitly how its sources of repo funding were drying up. Over the past decade, he has focused increasingly on global debt dynamics, money creation, and on the distortions created by central banks. He has also written extensively on market liquidity.

Matt was previously global markets strategist and head of credit strategy at Citi, and prior to that European credit strategist at JPMorgan. He has an MA in Social and Political Sciences from Emmanuel College, Cambridge.

"I'm lost without your charts!"

"Even in retirement I read your work. It goes to show how interesting it is."

"One of the best thinkers and speakers I have come across in my 30 years of banking."

"Inspiring insights."

"Always been the biggest fan of your slide pack. You are the best strategist out there hands down."

"Always thought-provoking and contrarian, without appearing as though that was the goal."

"Legend... a pleasure to have followed your thought process on markets."

"An inspiration and an oracle."

"Really enjoy your analysis and how you present it."

"An amazing inspiration."

"Some of the most insightful analysis on the street."

"Brilliant analysis and content."

"The most concise yet thorough explanation... of the panic that hit in 2007-08. The paper puts King in a rare category of people who really did understand what was happening, as it was happening, and tried to tell others."

Click here to join our free mailing list, or get in touch.