Skip to content

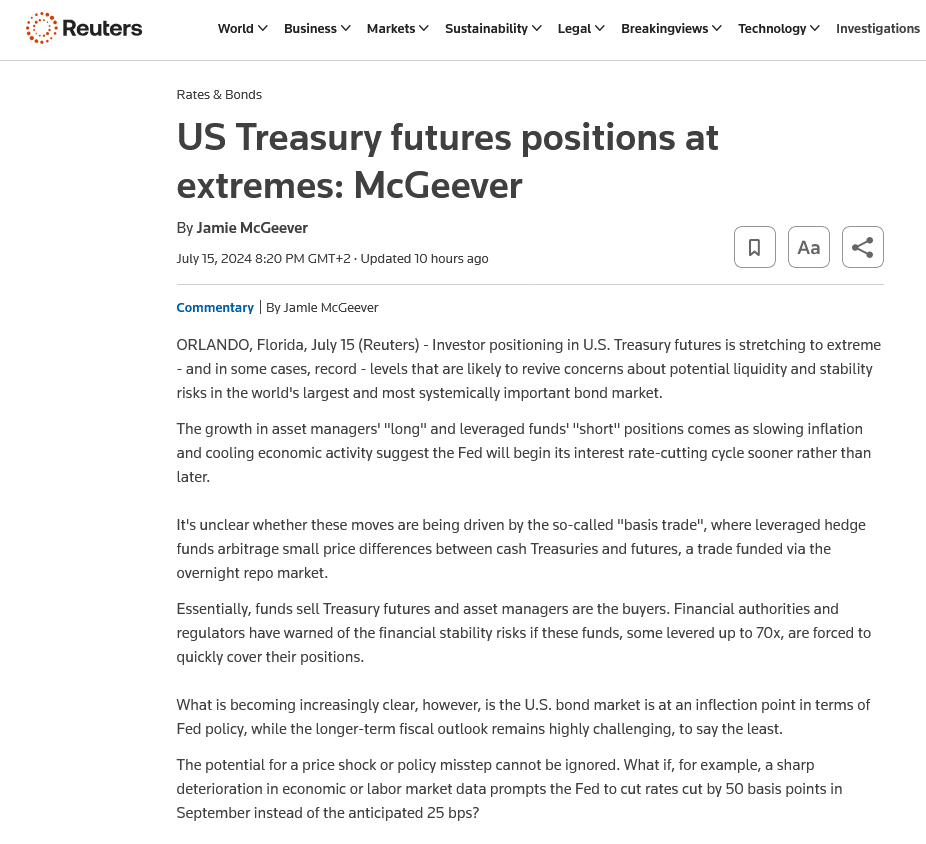

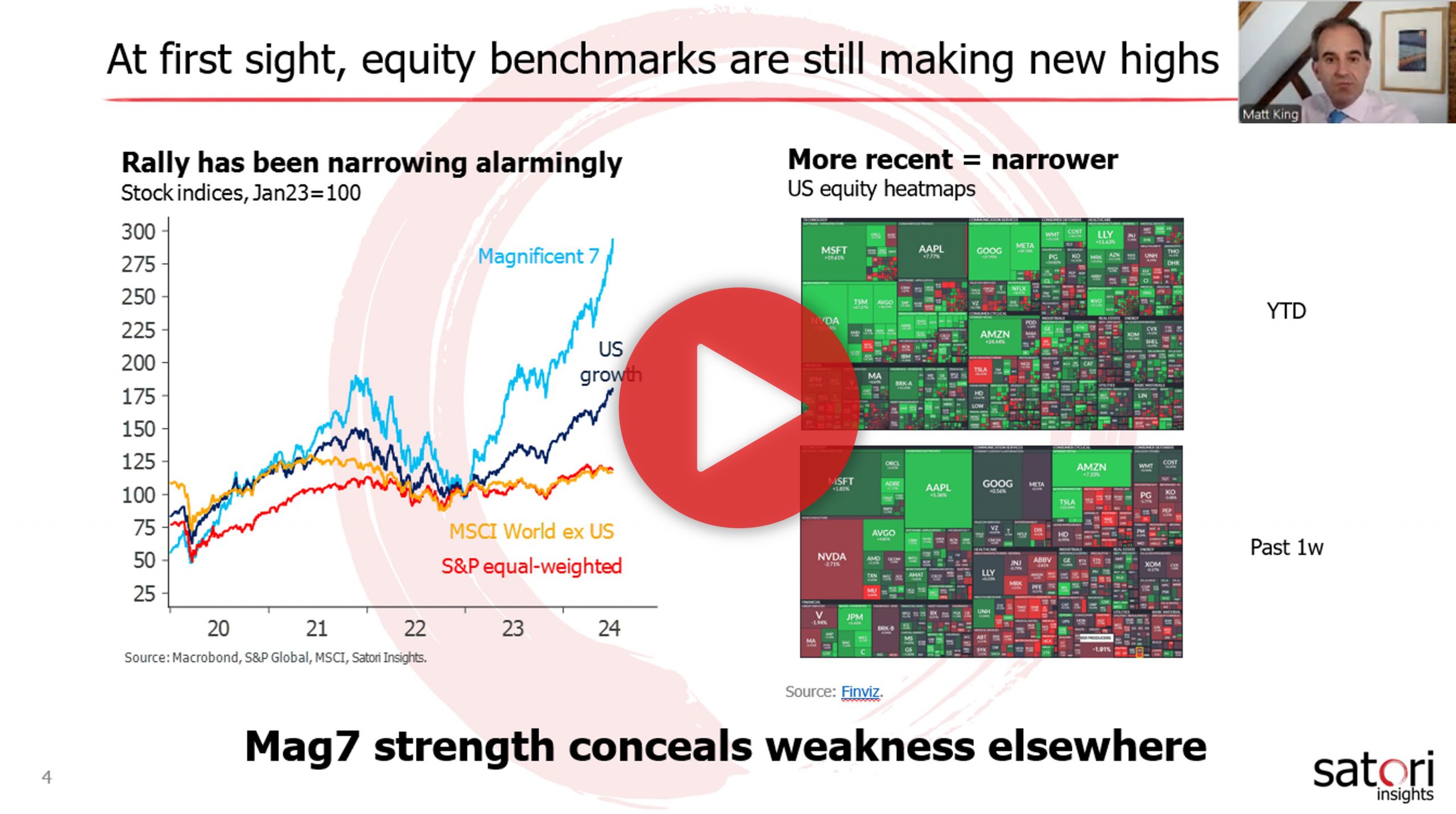

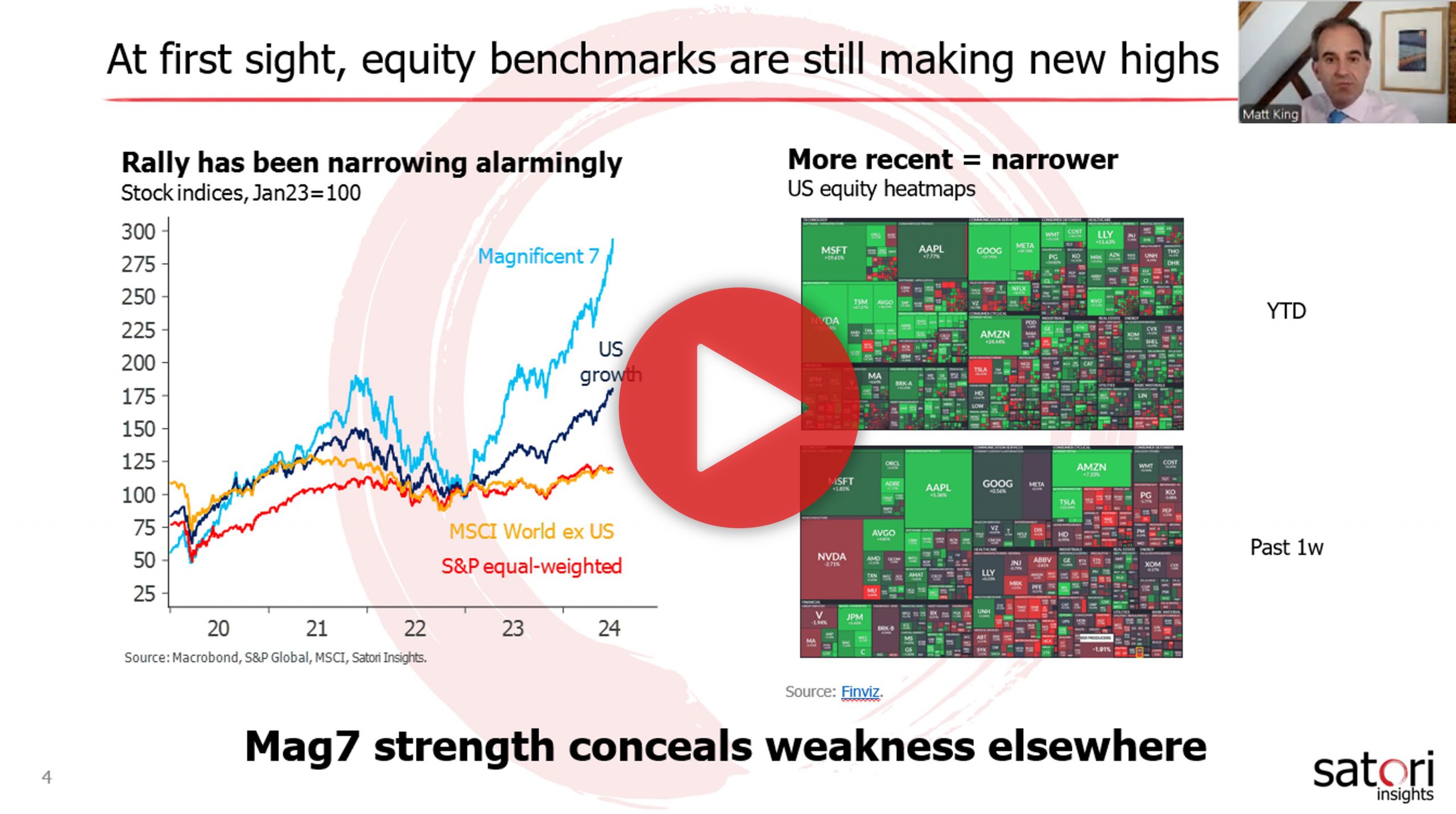

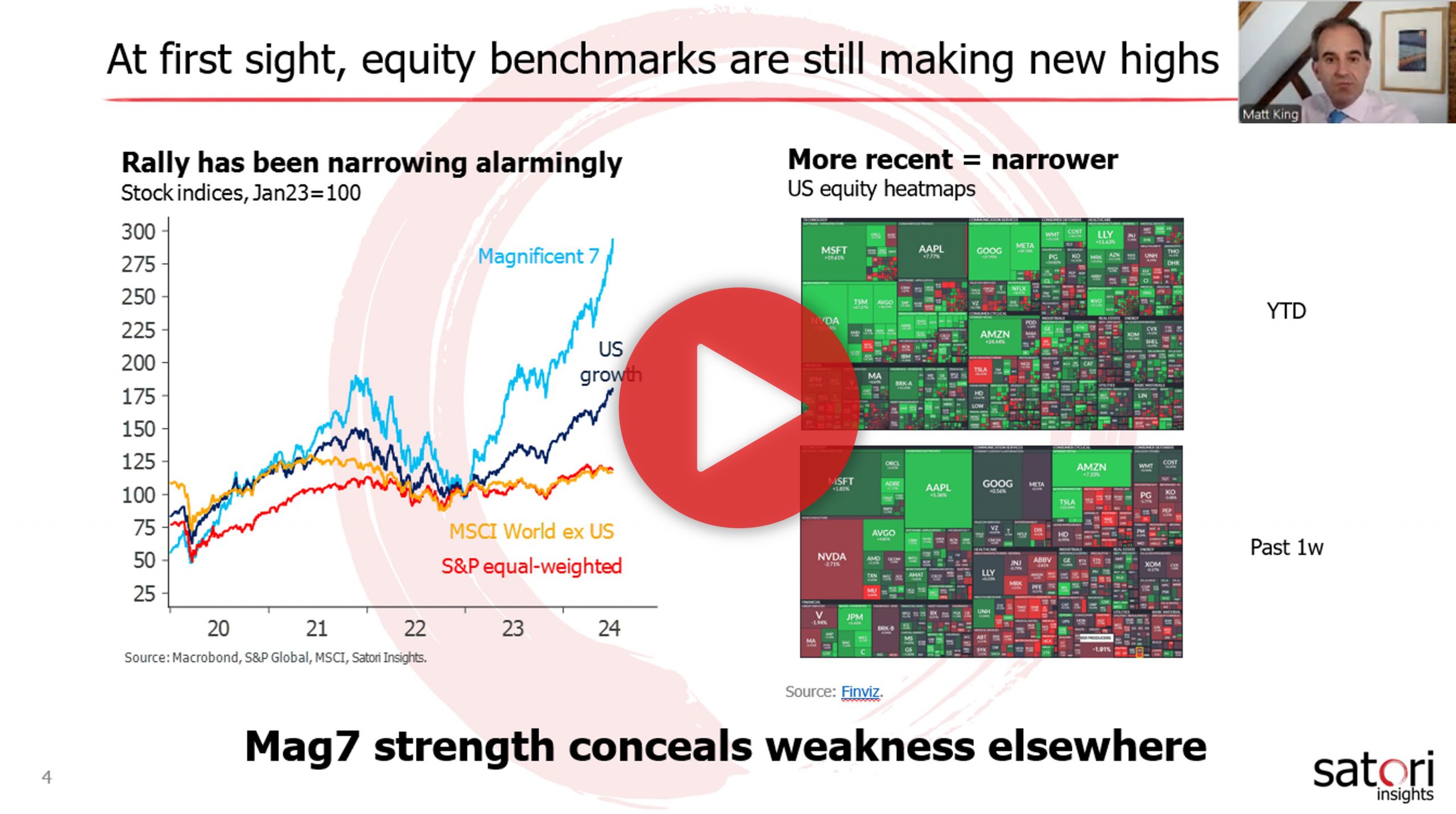

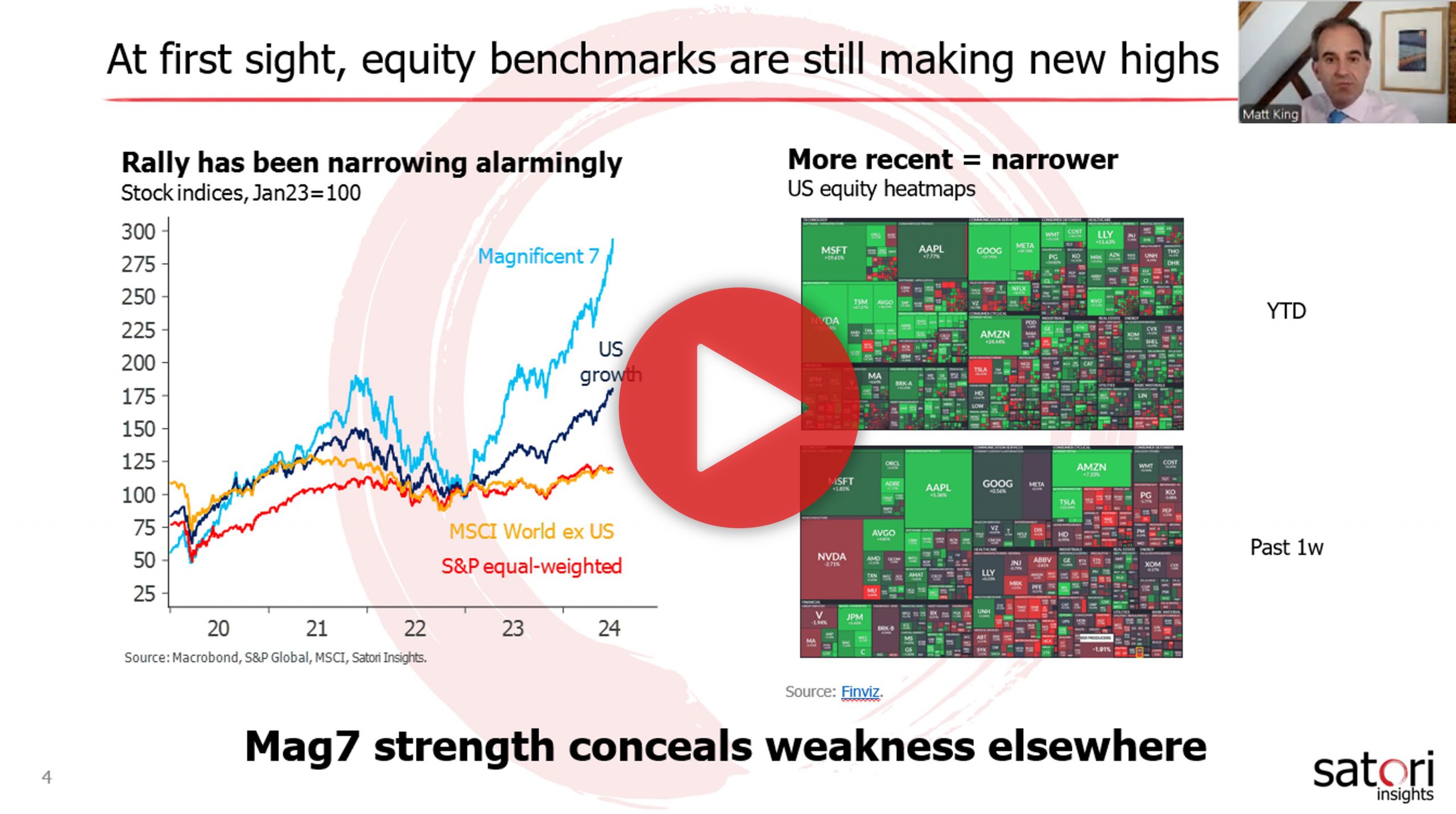

- The violent rotation in equities is sparking hopes of a fundamentally-driven rally

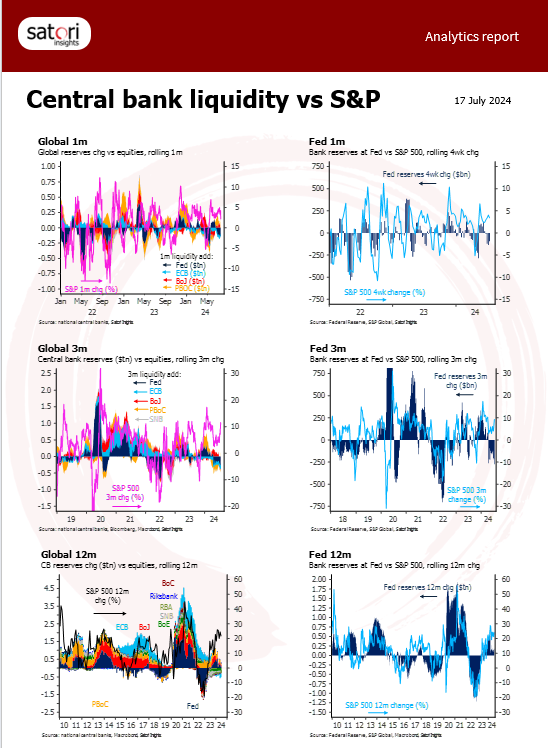

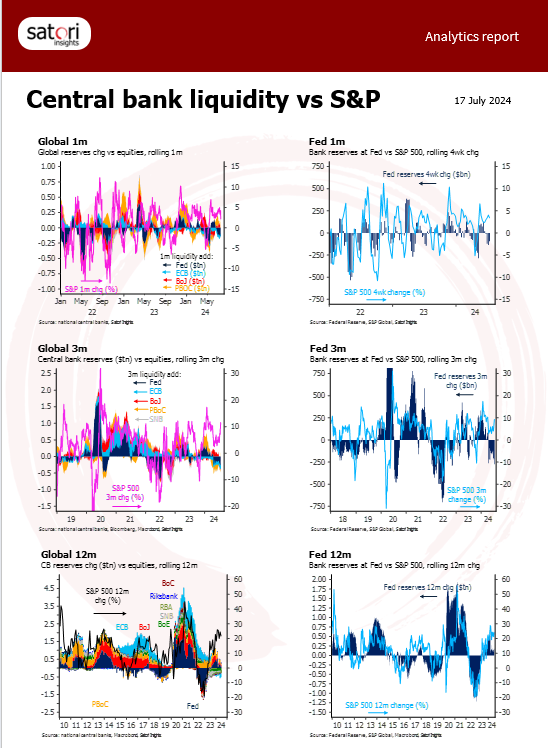

- It has been aided by record fund inflows and a spike in CB liquidity

- But the details of both the flows and the liquidity leave us skeptical

- Expect the rotation to continue, but not the rally

- Up-to-date snapshot of the most important flows & liquidity metrics

- CB liquidity vs multiple markets

- Private vs central bank credit

- Mutual fund+ETF flows

- CB balance sheet details

- Free clip from first ten minutes of 3 July webinar

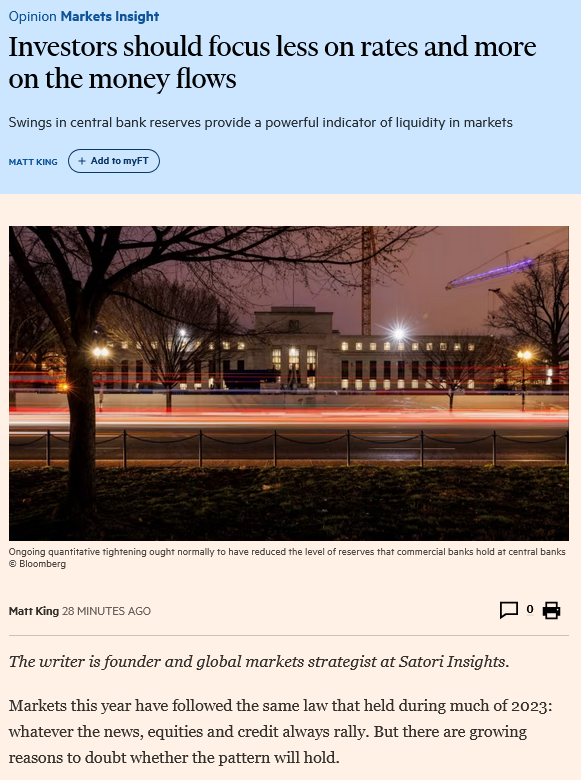

- Even as the rally continues, it does so on ever more fragile foundations

- The problem lies neither with the economy, nor with central banks being slow to lower rates, nor even with politics

- It is that the liquidity which fuelled markets in H1 looks increasingly likely to be turned off

- Full replay of 3 July webinar with Q&A

- Even as the rally continues, it does so on ever more fragile foundations

- The problem lies neither with the economy, nor with central banks being slow to lower rates, nor even with politics

- It is that the liquidity which fuelled markets in H1 looks increasingly likely to be turned off

- Open to clients with Group Webinar or One-on-One subscriptions, and to the press

- Recent softness in risk is not just the fault of France

- The underlying drivers of the rally have been faltering

- The outlook for H2 just darkened considerably

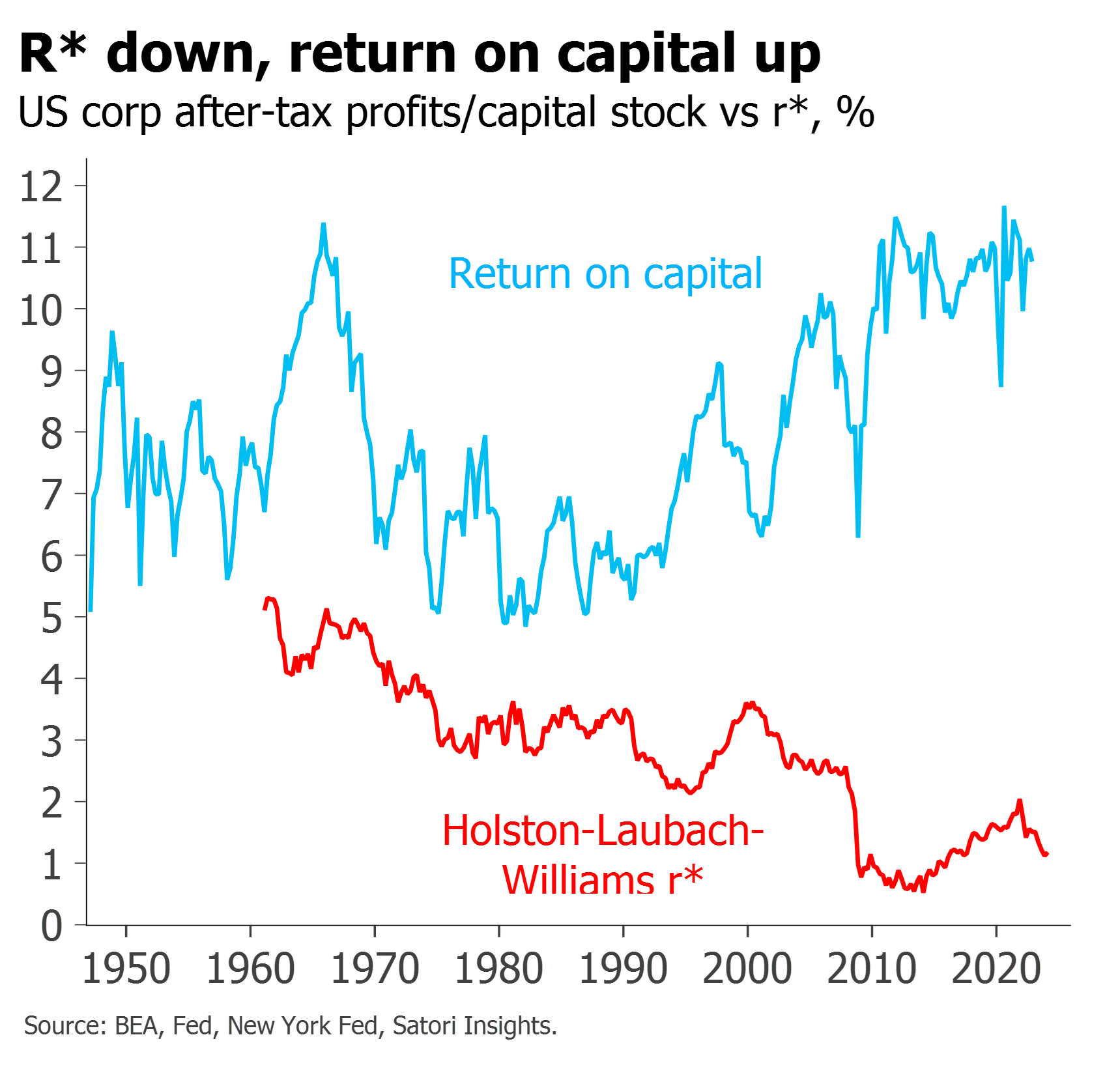

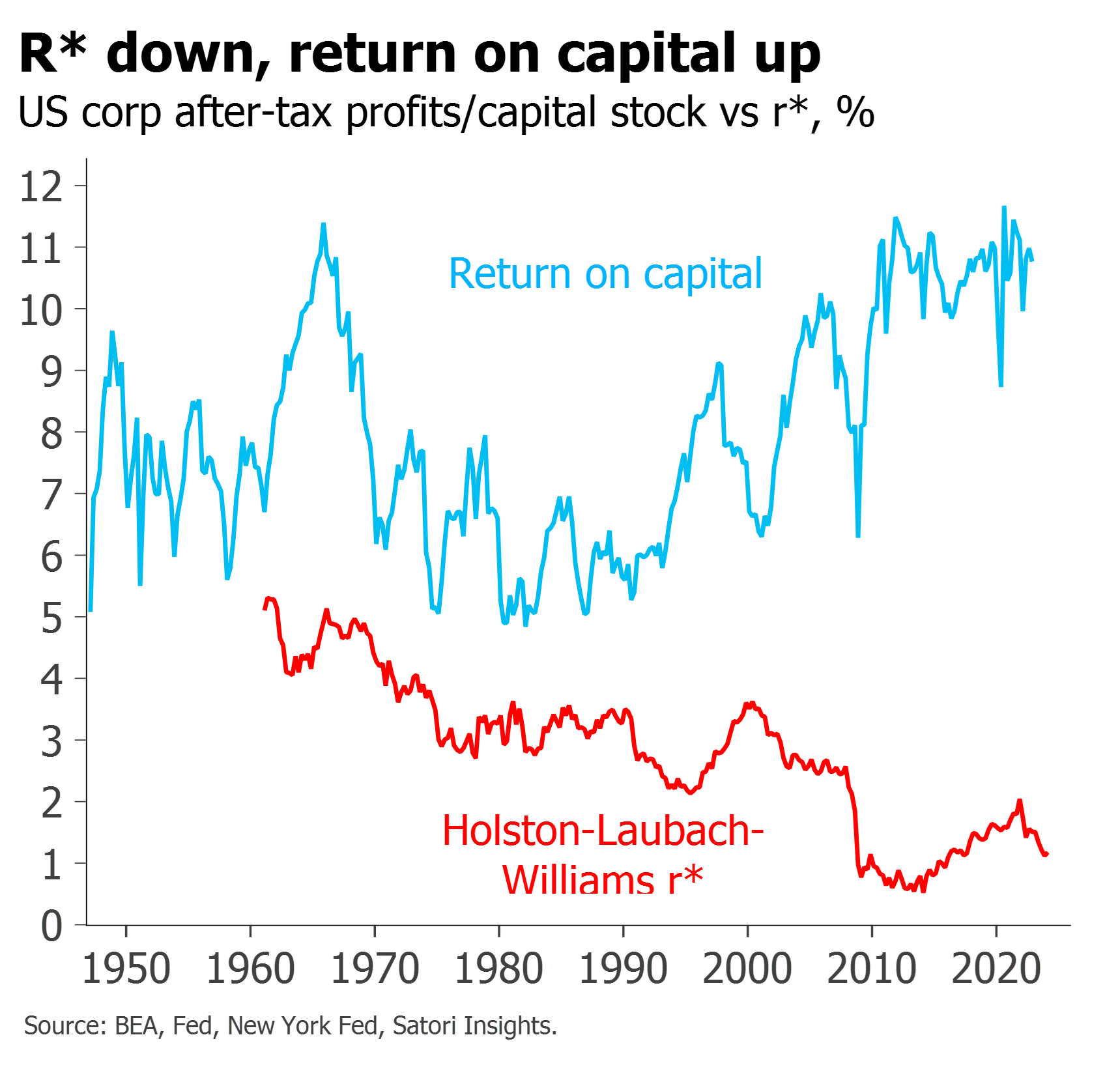

- Recent statements are a reminder of the importance of neutral rates for policymakers

- But they also illustrate confusion – not only about the level of r*, but even as to what it is supposed to be measuring

- At the heart of the confusion lies a failure to distinguish between the impact of balance sheet on markets, and of rates on the economy

- This potentially leads to very different conclusions for r* and policy

- Markets and economies should be analyzed as ‘complex systems’

- Their fat tails and emergent behaviours fit poorly with traditional linear economics, but very well with complexity modelling techniques

- Lessons from other complex arenas apply equally well to investing