Skip to content

- Financial conditions have eased to the same levels as 2007

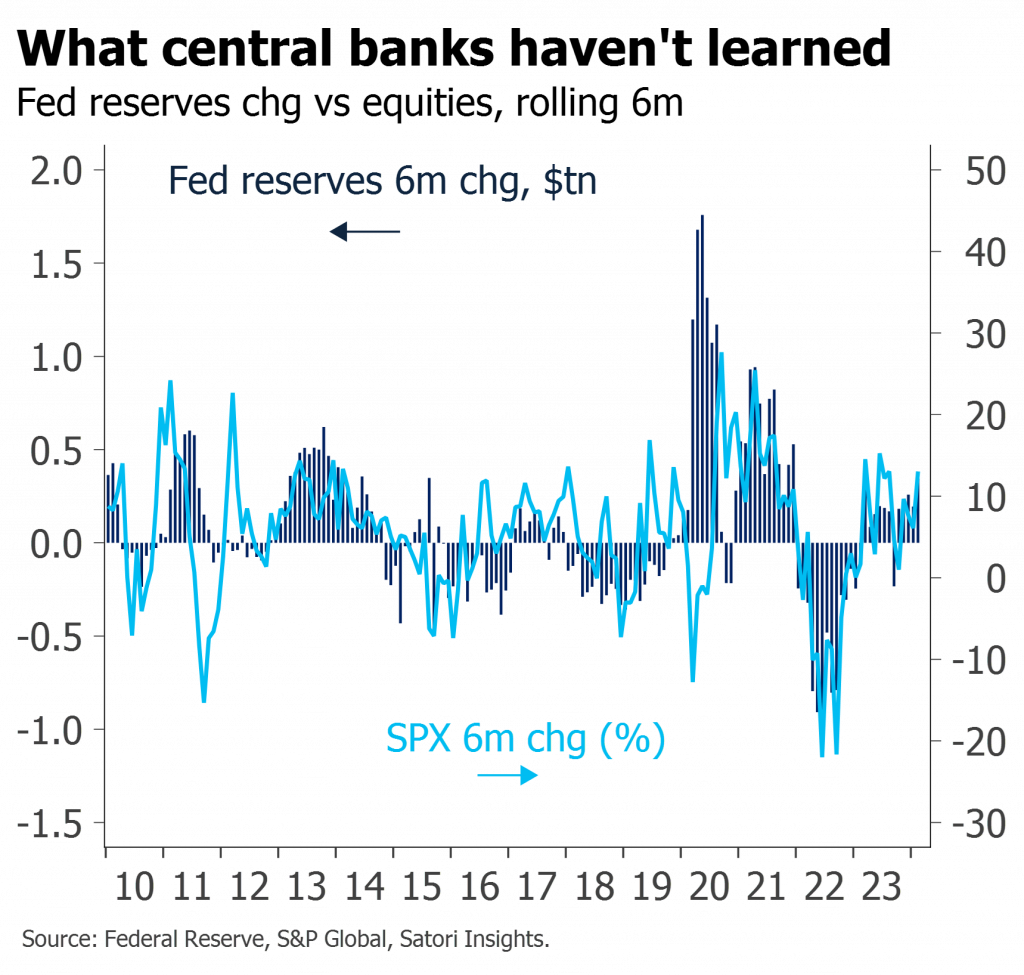

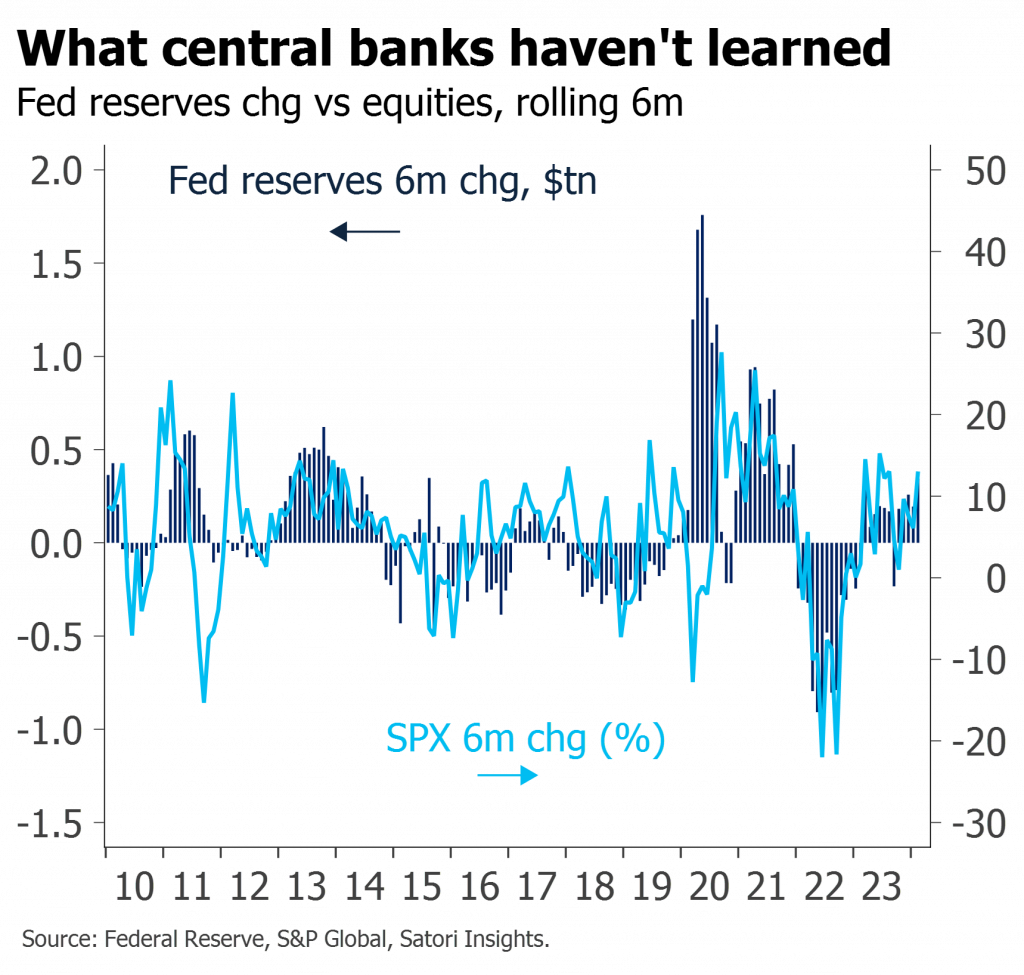

- This comes in spite of central banks thinking they are running restrictive policy

- The nature and timing of the market moves suggest these not so much reflect or anticipate the strength of the economy as drive it

- Their ultimate cause is easy balance sheet policy having crowded investors into risk

- Misunderstanding of these dynamics increases the likelihood of bubbles and subsequent busts

- The latest central bank research on QT is careful, rigorous, and grounded in the literature

- Unfortunately its main conclusion – that QE affects markets while QT doesn’t – is at odds with the lived experience of most market participants

- There is a much simpler reason why QT has had so little apparent impact

- Misunderstanding of this dynamic greatly contributes to the likelihood of future policy mistakes