Skip to content

Free clip from first ten minutes of 3 July webinar

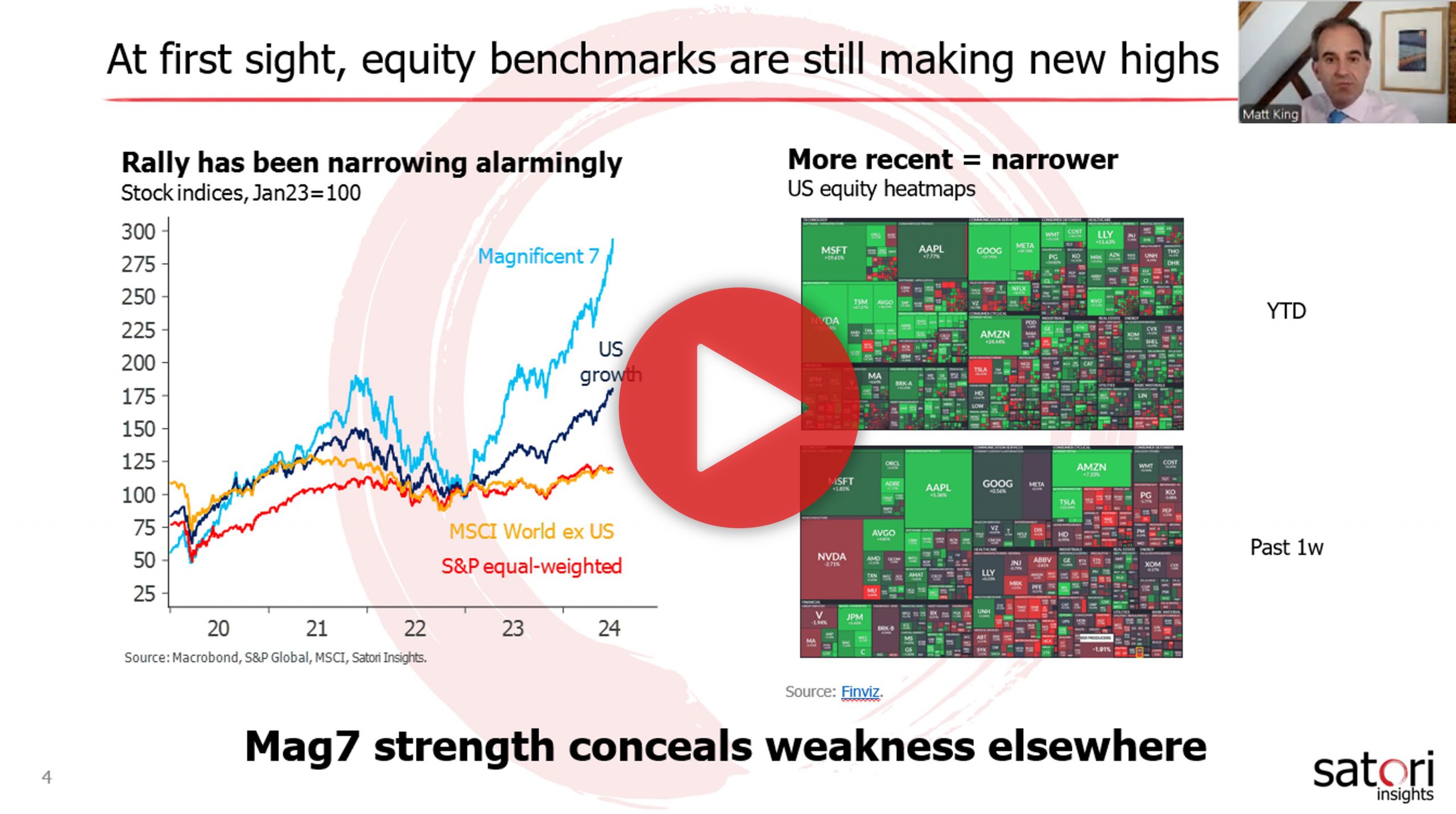

Even as the rally continues, it does so on ever more fragile foundations

The problem lies neither with the economy, nor with central banks being slow to lower rates, nor even with politics

It is that the liquidity which fuelled markets in H1 looks increasingly likely to be turned off

Free clip from first ten minutes of 2 May webinar

The exuberance in risk assets is less a consequence of a stronger economy than a driver of it

The expectation of rate easing was never critical – which is why the exuberance has largely persisted even as yields have backed up

It is instead the direct consequence of investor crowding following easy central bank balance sheet policy – and vulnerable to any reduction in CB liquidity

Free-to-view replay of first segment of 16 Jan webinar

Why strategists struggled in 2023

A better way to think about markets

Implications for 2024

Hark! The VC angels sing

God rest ye, merry crypto bros

While PMs watched tech stocks take flight

I’m dreaming of a tight market

To be sung, please, in a spirit of global harmony

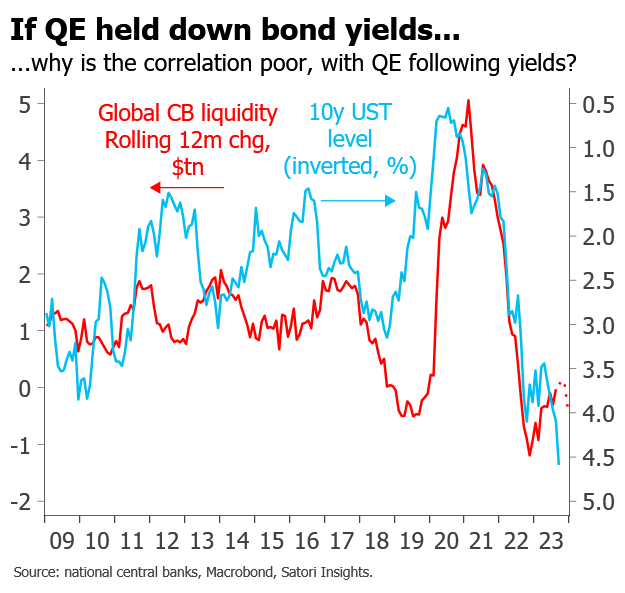

It is often said that QE held down bond yields, meaning QT should be a major contributor to this year’s rise

But the evidence for this is deeply questionable

QE does indeed hold down real yields, through a portfolio balance effect

But it also pushes up inflation breakevens via signalling

What is missing so far from this round of QT is the historical fall in breakevens

The true driver of higher bond yields lies with inflation, not QT