Skip to content

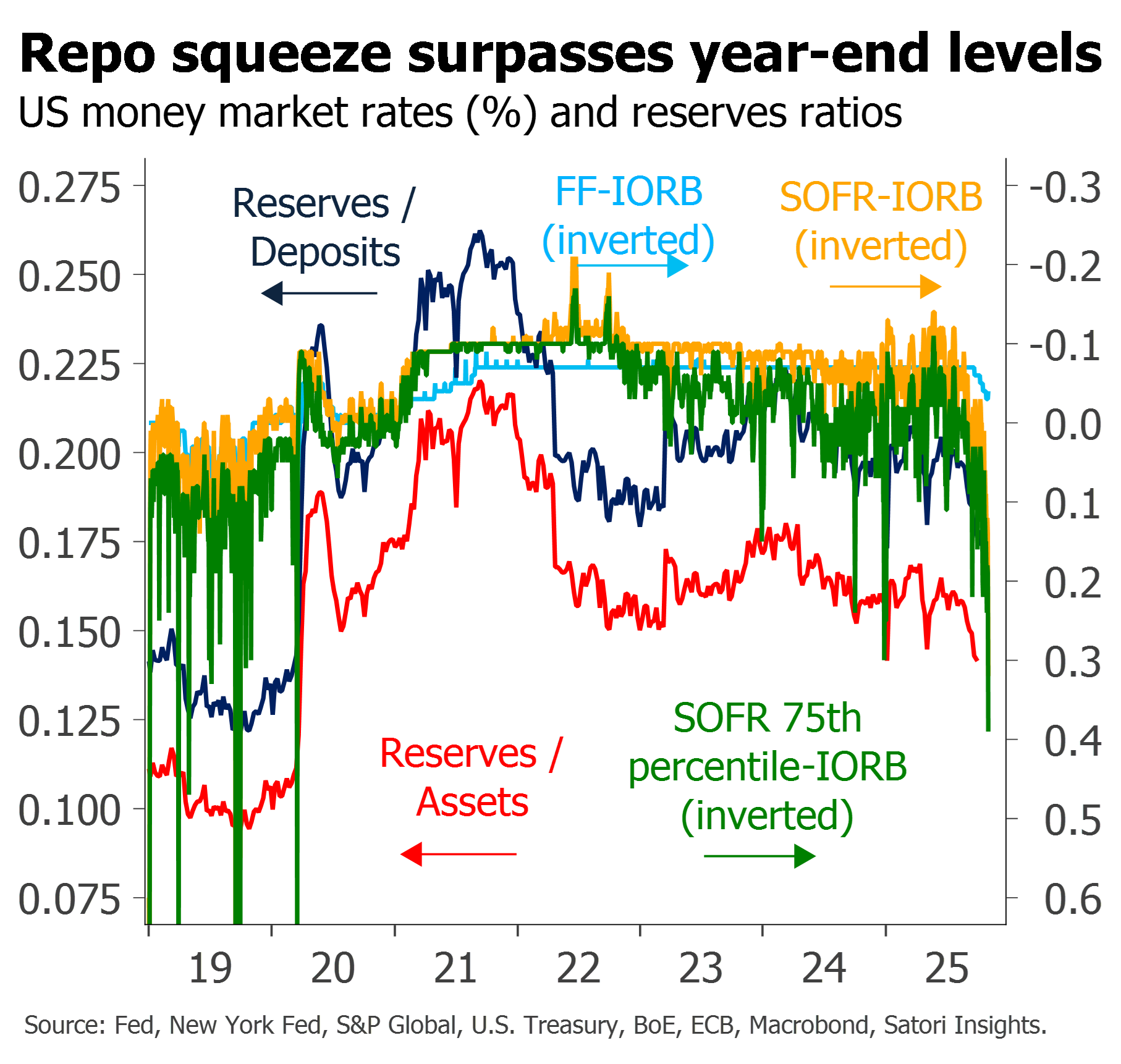

US repo rates have already spiked beyond year-end levels

The squeeze seems likely to continue – and intensify – while the US government shutdown does

The immediate consequences are $-positive and risk-negative – but mostly point to a deeper unwind of crowded hedge fund positions

In a narrow technical sense, the FOMC was indeed hawkish

But in the cessation of QT and through questions, it more broadly reconfirmed a reaction function at once deeply asymmetric and completely oblivious to asset price inflation

This paves the way for a further melt-up in risk assets and havens – and for more assets to exhibit the sort of exponential sawtooth boom-bust recently seen in gold

Full replay of 22 Oct webinar

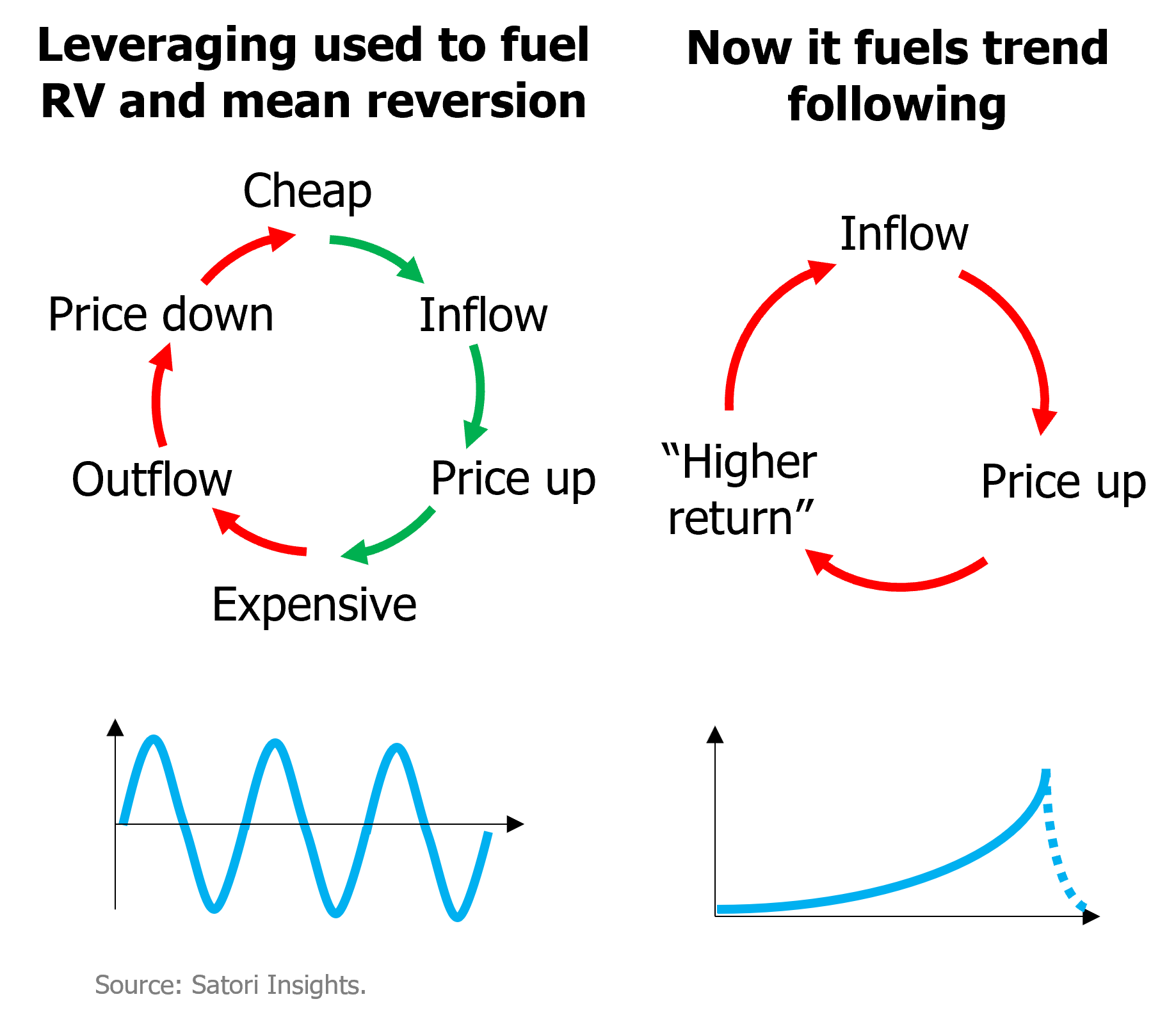

The fuel for the rally comes from a mix of fiscal stimulus being channelled into fund flows and financial sector leveraging

But cracks are beginning to appear, from First Brands, to doubts about circular financing in tech, to the flight into gold

To understand the limits of leveraging, look at the fund flows

First third free to view; full version only for clients with Group Webinar and One-on-one subscriptions

Free clip from 22 Oct webinar

The fuel for the rally comes from a mix of fiscal stimulus being channelled into fund flows and financial sector leveraging

But cracks are beginning to appear, from First Brands, to doubts about circular financing in tech, to the flight into gold

To understand the limits of leveraging, look at the fund flows

First ten minutes free to view; full webinar only for clients with Group Webinar and One-on-one subscriptions

The fuel for the rally comes neither from rates, nor from fundamentals, nor from central bank liquidity

It stems from a mix of fiscal stimulus being channelled into fund flows and financial sector leveraging

The resultant mix of too much money chasing too few assets both suppresses risk premia and postpones credit events – to a point

But it remains critically dependent on the continued credibility of the borrowers and the system