Webinar: Why are financial conditions so benign? old

- Webinar Thu 2 May 1430 Lon / 0930 NY

- The exuberance in risk assets is not just a consequence of a stronger economy, but a driver of it

- The expectation of rate easing was never a main driver – which is why it has largely persisted even as yields have backed up

- It is instead the direct consequence of investor crowding following easy central bank balance sheet policy – and vulnerable to any reduction in CB liquidity

- Open to clients with Group Webinar or One-on-One subscriptions, and to the press

Webinar: The yield is not enough

- Webinar Wed 1 Nov 1600 Lon / 1200 NY

- Is the mini-correction in markets a foretaste of something bigger, or does the still-strong real economy give risk assets scope to bounce back?

- Should investors be rotating out of equities and into bonds, or are the latter still vulnerable to buyers’ strikes against a backdrop of fiscal indiscipline?

- Open to clients with Group Webinar or One-on-One subscriptions, and to the press

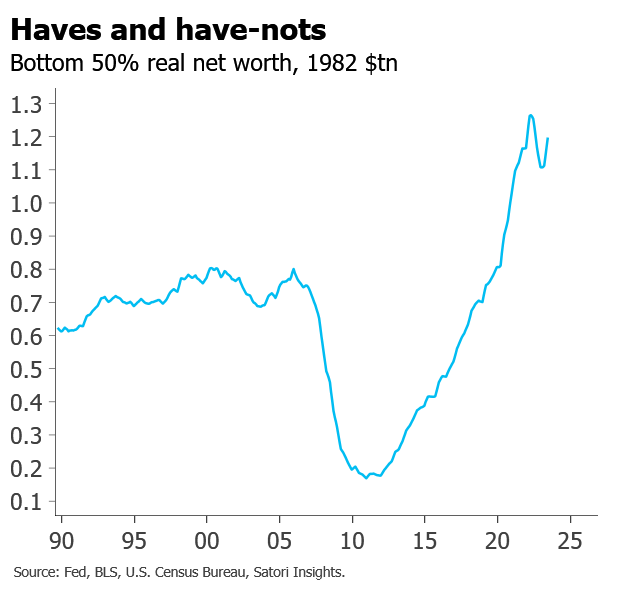

Distributional accounts

This is a test of various chart sizes. Deposits – especially in real terms – have been falling sharply, and those for the bottom quintiles are now back to pre-Covid levels. This is now 900×700, the full size original: Nevertheless, what’s striking to me is how much they’ve risen in general – especially during the […]

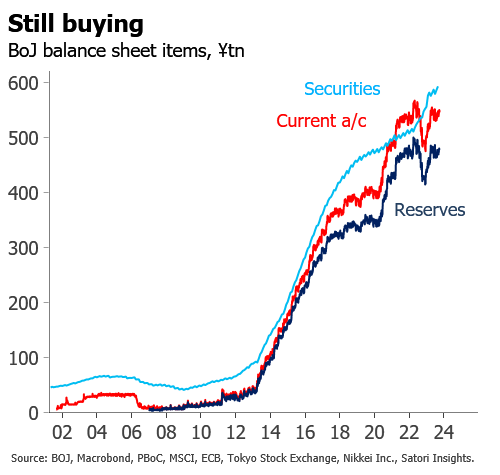

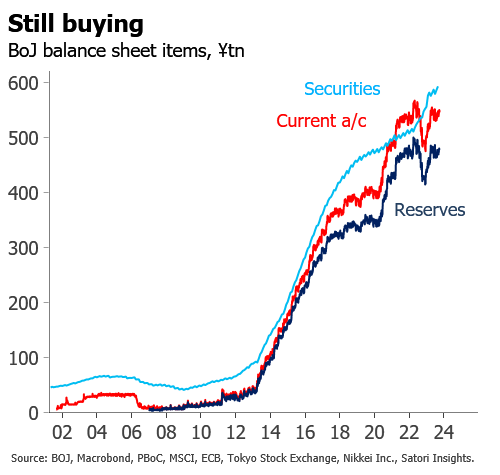

BoJ is only central bank still buying

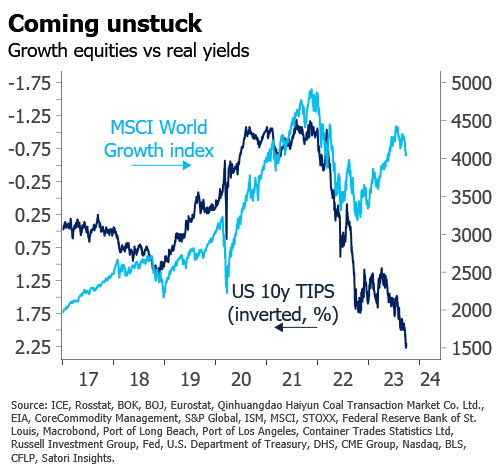

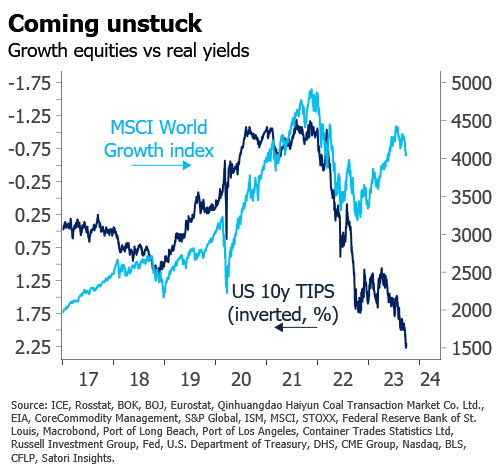

Real yields decoupling

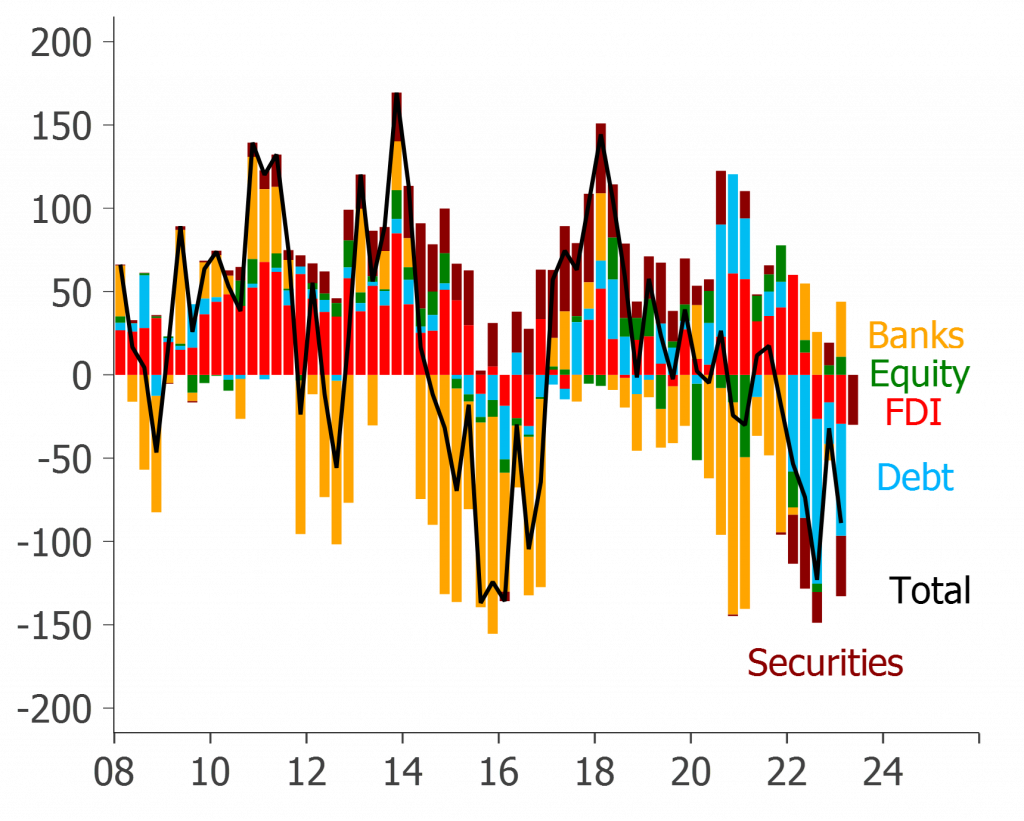

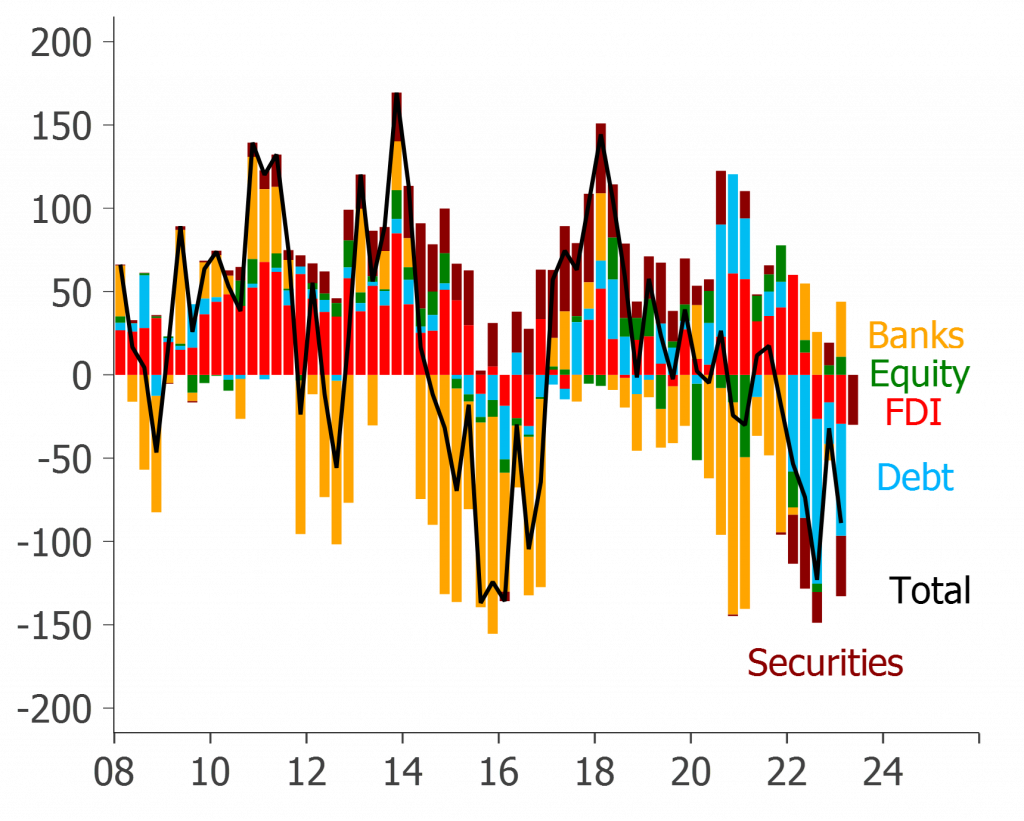

Capital flight from China

BoJ is only central bank still buying

Real yields decoupling

Capital flight from China