Skip to content

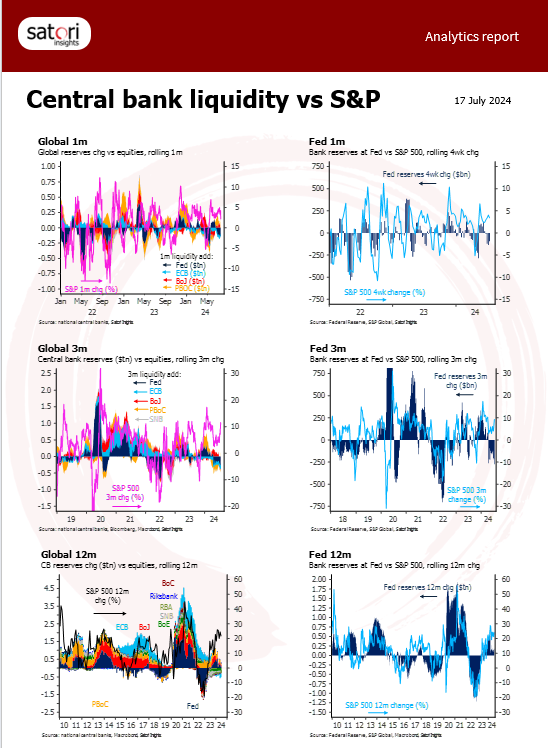

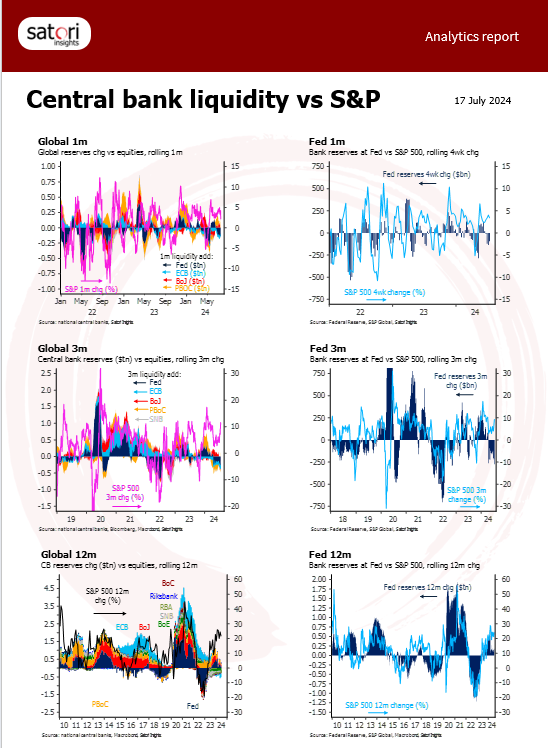

- Up-to-date snapshot of the most important flows & liquidity metrics

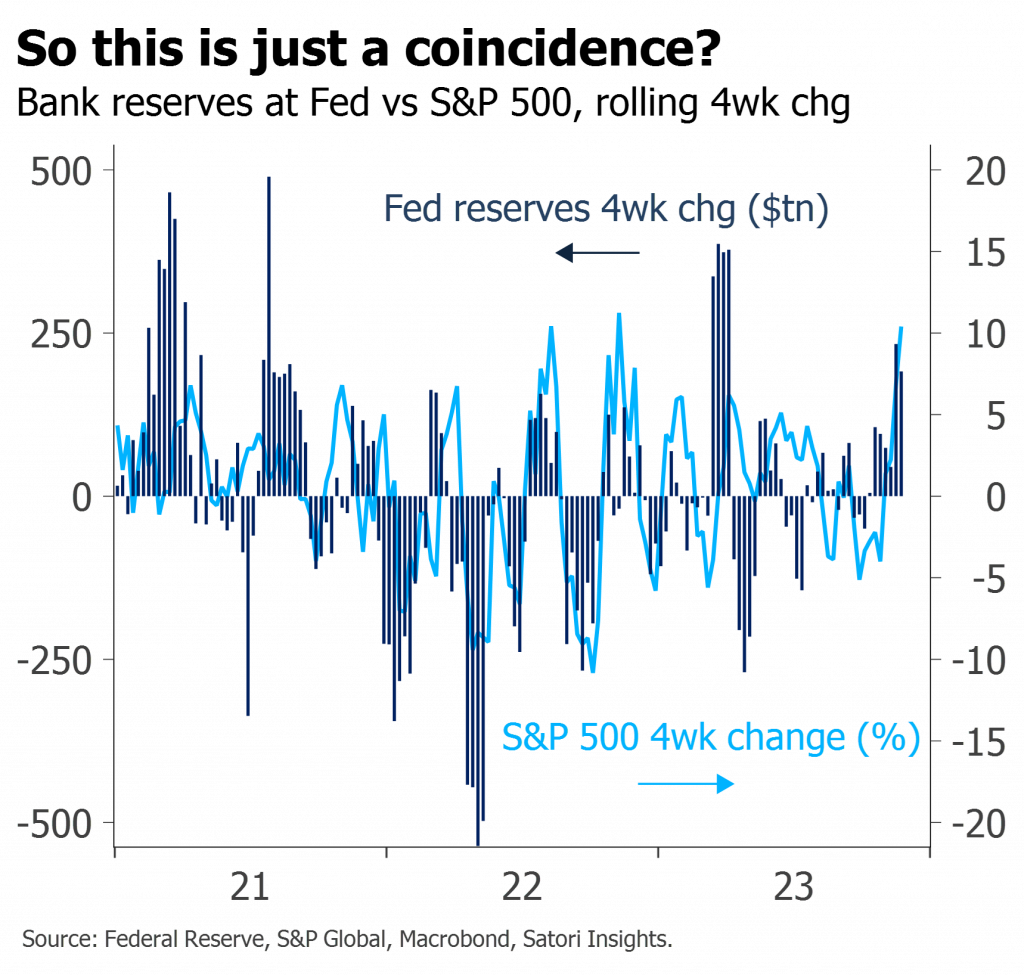

- CB liquidity vs multiple markets

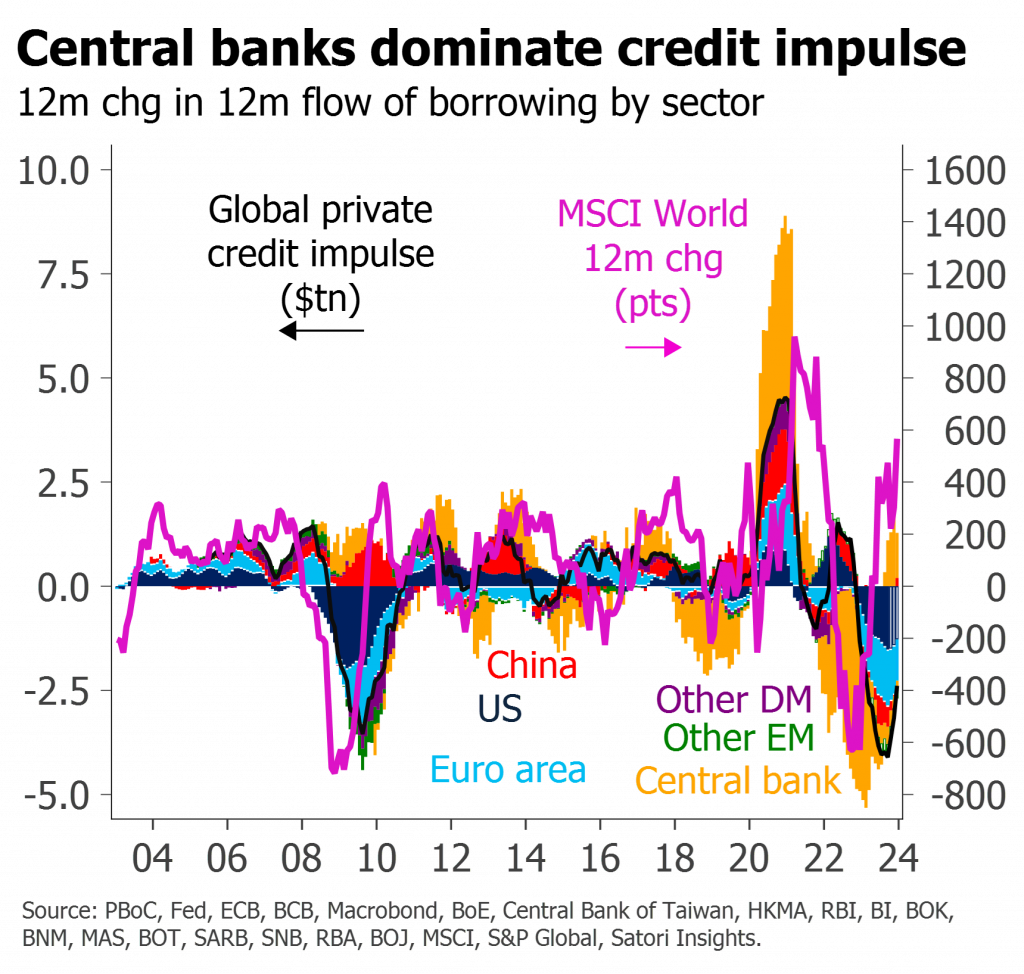

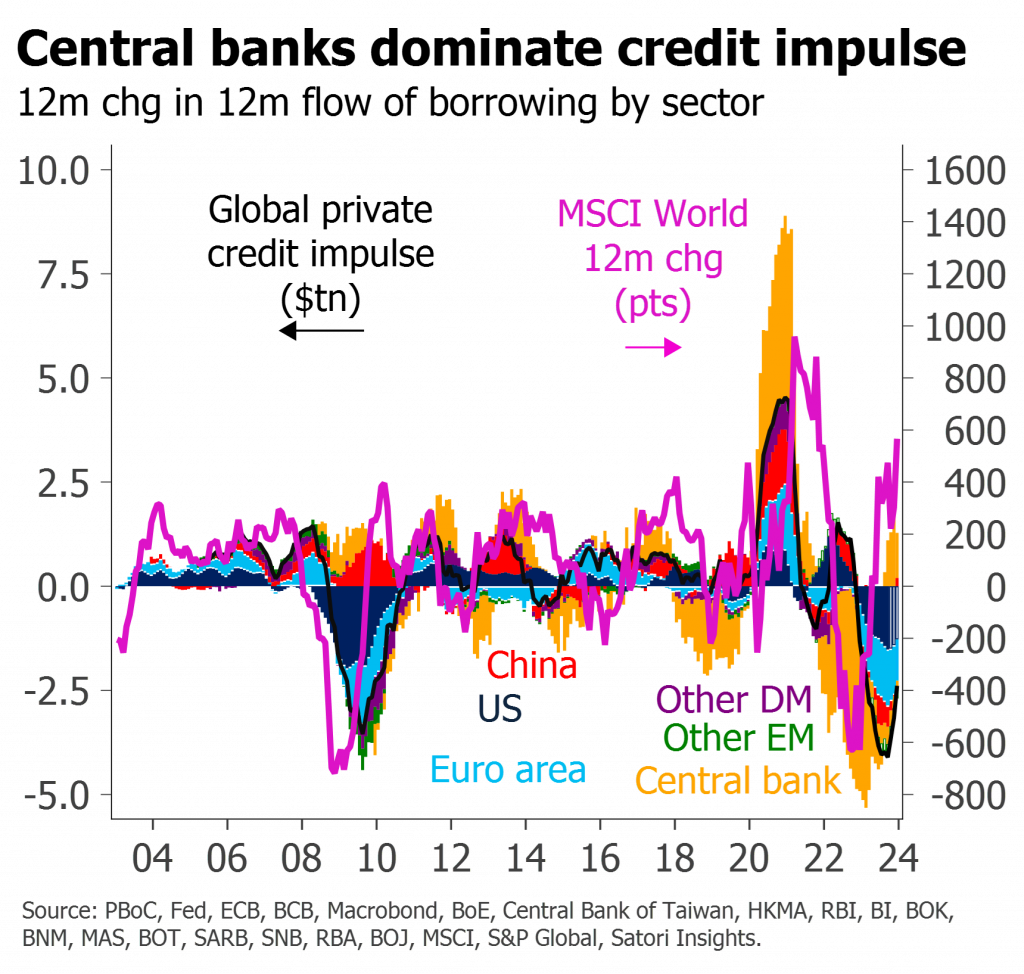

- Private vs central bank credit

- Mutual fund+ETF flows

- CB balance sheet details

- Recent softness in risk is not just the fault of France

- The underlying drivers of the rally have been faltering

- The outlook for H2 just darkened considerably

- Financial conditions have eased to the same levels as 2007

- This comes in spite of central banks thinking they are running restrictive policy

- The nature and timing of the market moves suggest these not so much reflect or anticipate the strength of the economy as drive it

- Their ultimate cause is easy balance sheet policy having crowded investors into risk

- Misunderstanding of these dynamics increases the likelihood of bubbles and subsequent busts

- Financial conditions have eased to the same levels as 2007

- This comes in spite of central banks thinking they are running restrictive policy

- The nature and timing of the market moves suggest these not so much reflect or anticipate the strength of the economy as drive it

- Their ultimate cause is easy balance sheet policy having crowded investors into risk

- Misunderstanding of these dynamics increases the likelihood of bubbles and subsequent busts

- The remarkable performance of risk assets in 2023 is not primarily due to the growing likelihood of a soft landing

- It instead reflects markets being buffeted by extraordinary amounts of central bank liquidity

- For now, those technicals remain positive, but beyond Q1 they should fade or reverse

- Underlying momentum in growth, earnings and inflation – beyond sticky supply-side effects – is significantly weaker

- The rally does not reflect the likelihood of a soft landing

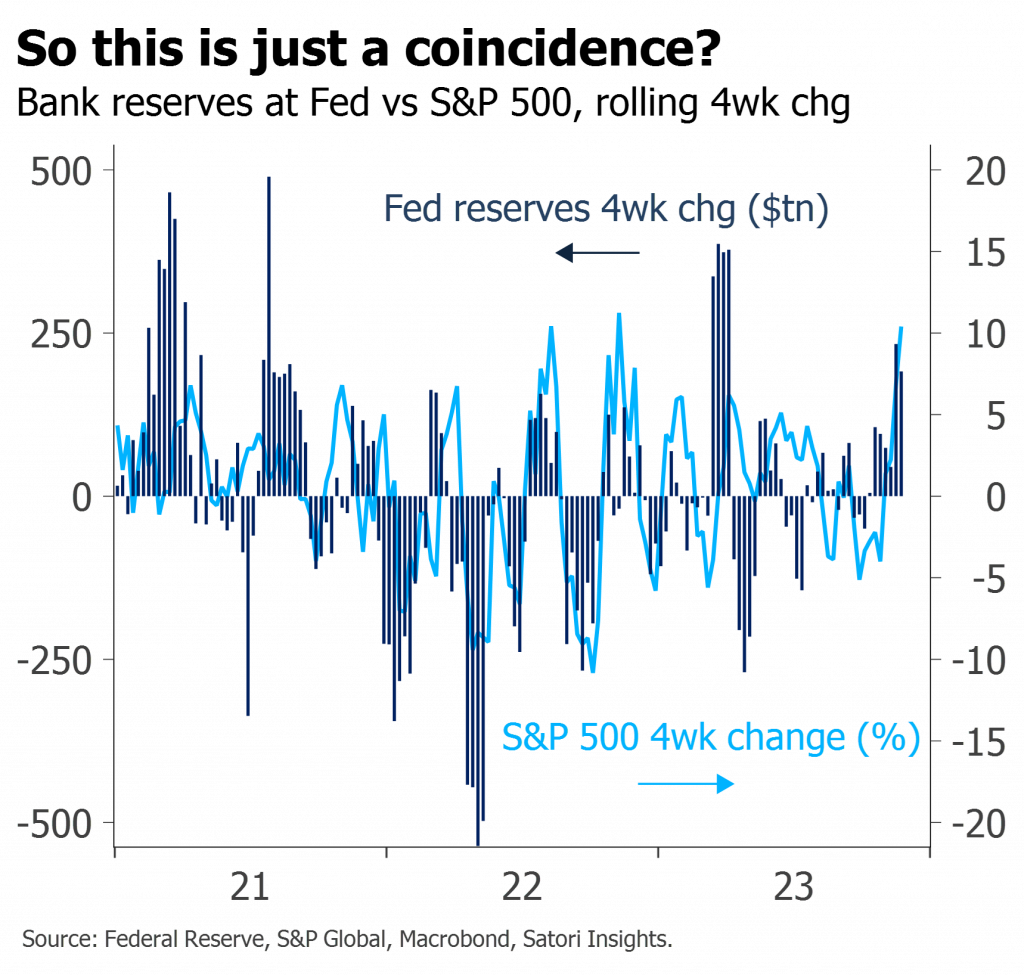

- It is the direct consequence of a surge in Fed liquidity

- Widespread misunderstanding of these dynamics increases the likelihood of more rate rises and a harder landing later

- It’s not just a stronger economy

- Nor even those long and variable lags

- It’s that markets are being driven by money flows and not rate levels